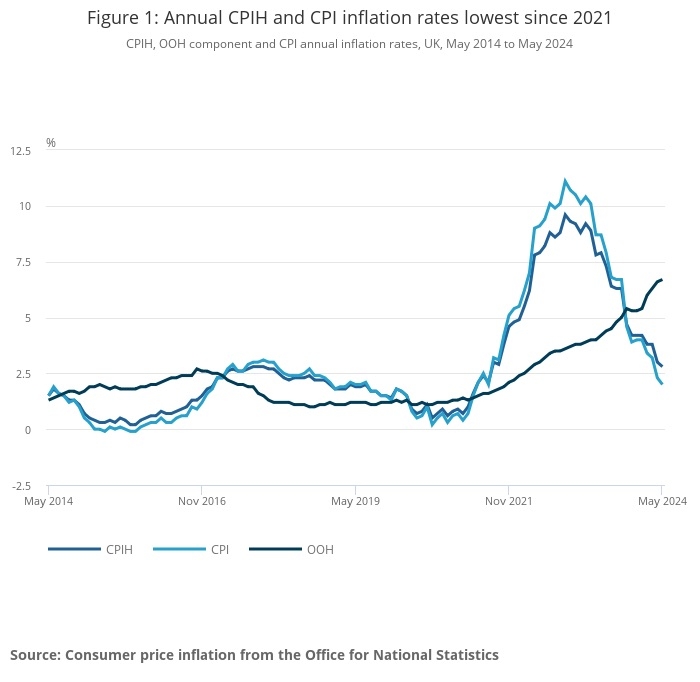

CPI inflation continued its rapid downward trend, falling in May to the Bank of England's long-term target of 2% from 2.3% the previous month.

Official figures from ONS out today suggest inflation fell across most goods and services last month.

The Consumer Prices Index (CPI) rose 2% in the 12 months to May 2024, down from 2.3% in the 12 months to April.

On a monthly basis, CPI rose 0.3% in May, compared with a rise of 0.7% in May 2023.

The sister index, the Consumer Prices Index including owner occupiers’ housing costs (CPIH), rose 2.8% in the 12 months to May 2024, down from 3% in the 12 months to April. On a monthly basis, CPIH rose by 0.4% in May 2024, compared with a rise of 0.6% in May 2023.

The ONS reported that the largest downward contribution to the monthly change in CPIH and CPI annual rates came from food, with prices falling this year after rising rapidly last year.

The biggest upward contribution came from motor fuels, with prices rising slightly this year after falling a year ago.

Core CPIH (excluding energy, food, alcohol and tobacco) rose 4.2% in the 12 months to May 2024, down from 4.4% in April.

Core CPI (excluding energy, food, alcohol and tobacco) rose 3.5% in the 12 months to May 2024, down from 3.9% in April.

RPI, the older measure of inflation, fell from 3.3% in April to 3% in May.

There was less good news for home owners and occupiers. The owner occupiers’ housing costs (OOH) component of CPIH rose 6.7% in the 12 months to May, up from 6.6% in the 12 months to April. This is the highest annual rate since July 1992, ONS said. OOH costs rose by 0.6% on the month, compared with a 0.5% increase between April and May 2023.

Despite rising housing costs, industry experts were positive about the drop in CPI but warned the road ahead could be bumpier than expected.

James McManus, chief investment officer at digital wealth manager Nutmeg, said: “Today feels like a milestone moment on the long road to bringing inflation back under control, as headline CPI hits the Bank of England’s 2% target.

"Energy prices have been a significant driver in bringing this figure down and consumers should be starting to see the benefit of lower energy prices in their bills. However, anyone hoping today’s data will encourage the Bank of England to go ahead with the first cut to interest rates tomorrow could well be disappointed. Core inflation is still running higher at 3.5%, services inflation at 5.7% and wage growth is around 6% year-on-year. Central bankers have given signals that they want to cut rates, and they are aware of the pressures higher borrowing costs are putting on households, but expectation is the first rate cut won’t be until later in the year.”

Lindsay James, investment strategist at Quilter Investors, “After a long and arduous period, UK inflation has finally returned to the coveted 2% target set by the Bank of England. Given inflation peaked at 11% two years ago, this is a big occasion for a UK economy that appeared blighted by inflation worse than comparable peers.

"That said, it is possible this joy will be short-lived. Much of the fall in recent months has been driven by the energy price cap, as well as food prices, which will be a diminishing factor in future months and so we expect inflation to go up again later this year and settle into a trajectory between 2% and 3%."

Andrew Summers, chief investment officer at Omnis Investments, said: “Seeing inflation back around the Bank of England’s target is welcome news, but the UK is not out of the inflation woods yet. This will probably be the lowest inflation level for this year, with small increases more likely as we approach 2025.

"In addition, service sector inflation is still too high for comfort albeit the trend is in the right direction. Nevertheless, a lot of progress has been made even if the path forward will be bumpy. This should still be enough for the Bank to cut rates a couple of times before the year is out, starting probably in August.”

Tom Stevenson, investment director at Fidelity International, said: “The return of inflation to the Bank of England’s 2% target is not the end of the cost-of-living crisis but it may mean we are through the worst.

“The drop in the headline rate of inflation to 2% is welcome news for the Prime Minister, Rishi Sunak, just a couple of weeks before the general election. It will be highlighted by the government as evidence that the economy has stabilised, despite growth stagnating in April."