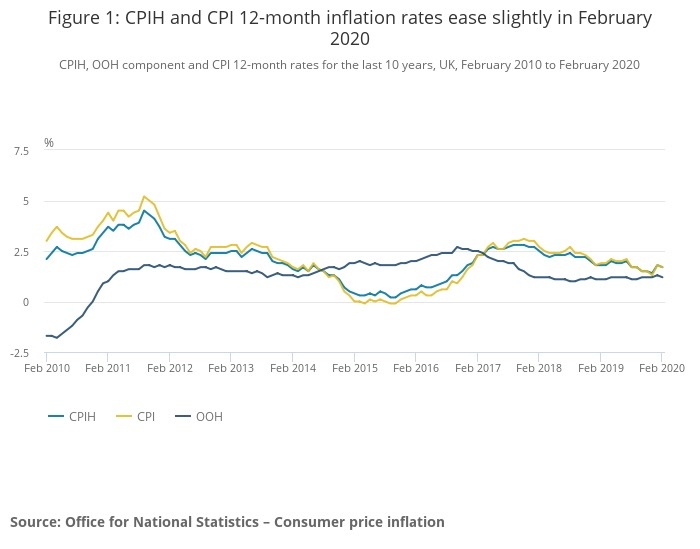

The Consumer Prices Index (CPI) 12-month rate fell from 1.8% in January to 1.7% in February.

The information was released this morning a few hours earlier than normal due to the Coronavirus outbreak.

ONS, which releases the information, said that starting today it will publish price sensitive information at 7 am rather than 9.30 am. Today’s figures were collated before

the outbreak took hold in a major way.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month inflation rate was the same at 1.7% in February, down from 1.8% in January 2020.

The biggest contribution to the fall in the CPIH 12-month inflation rate in February came from housing, water, electricity, gas and other fuels. ONS said the contributions to the change in the CPIH 12-month inflation rate were relatively small compared with movements in most months.

Price rises for recording media and for restaurant and hotel services produced the largest upward momentum.

ONS head of Inflation Mike Hardie said: “There was a slight slowing in the rate of inflation due mainly to falling prices for motor fuels and computer games.”