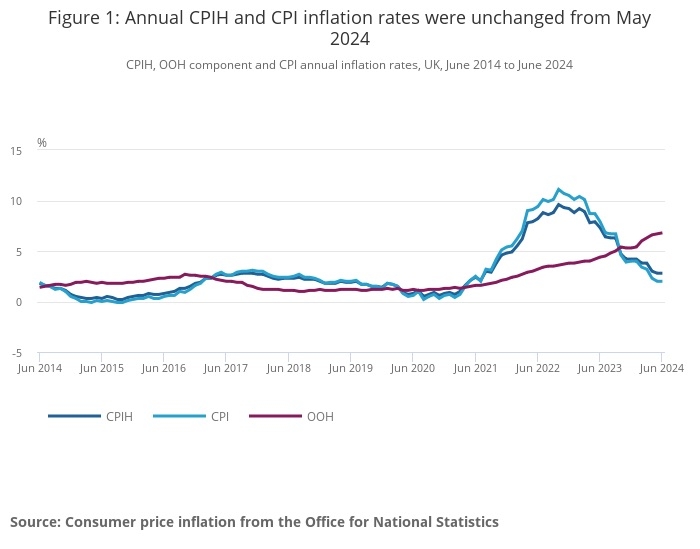

CPI inflation remained at 2% in June, the same as May, the ONS reported today.

The figure keeps CPI inflation in line with the Bank of England's 2% target for inflation.

CPI inflation has now stabilised after a rapid descent in recent months. It fell in May to 2% from 2.3% the previous month. It peaked at 11% in 2022.

CPIH (CPI plus housing costs) rose 2.8% in the 12 months to June, the same as the 12 months to May.

The CPI figure masked significant changes in the prices of some goods and services. For example, the cost of using restaurants and hotels rose sharply. Hotel prices were up 8.8% compared to May. There was also a significant rise in the cost of package holidays, cinemas, theatres and going to concerts.

Clothing and footwear provided downward pressure on inflation.

The older measure of inflation, RPI, rose by 2.9% (12 month figure).

Key facts from ONS:

- The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 2.8% in the 12 months to June 2024, the same rate as the 12 months to May 2024.

- On a monthly basis, CPIH rose by 0.2% in June 2024, the same rate as in June 2023.

- The Consumer Prices Index (CPI) rose by 2.0% in the 12 months to June 2024, the same rate as the 12 months to May 2024.

- On a monthly basis, CPI rose by 0.1% in June 2024, the same rate as in June 2023.

- The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from restaurants and hotels, where prices of hotels rose more than a year ago; the largest downward contribution came from clothing and footwear, with prices of garments falling this year having risen a year ago.

- Core CPIH (excluding energy, food, alcohol and tobacco) rose by 4.2% in the 12 months to June 2024, the same rate as in May; the CPIH goods annual rate fell from negative 1.3% to negative 1.4%, while the CPIH services annual rate rose from 5.9% to 6.0%.

- Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.5% in the 12 months to June 2024, the same rate as in May; the CPI goods annual rate fell from negative 1.3% to negative 1.4%, while the CPI services annual rate remained at 5.7%.

Tom Stevenson, investment director at fund manager Fidelity, said: “A second consecutive month of headline inflation at target makes a cut in interest rates on 1 August more likely but not yet a shoo-in. The key questions for the Bank of England rate setters remain persistently high service sector inflation and wage growth.

“It is a sign of how far we have come in the fight with inflation that today’s repeat 2.0% reading elicited a shrug. It is only 20 months ago that the UK was an inflation outlier with prices rising at 11.1%. But policy makers are more concerned with the pace of price rises in the service sector, which accounts for 80% of the UK economy, and which remained unchanged at 5.7%. Core inflation, excluding energy and food, was also flat at 3.5%."

Richard Carter, head of fixed interest research at Quilter Cheviot, said: “In what are the new Labour government’s first set of figures, everyone on the front benches will be breathing a sigh of relief that inflation has stuck rigidly to the 2% target. With two consecutive months of at target inflation now reported, the Bank of England should now have enough room to enact its first rate cut in over four years. This will delight Chancellor Rachel Reeves and give a fresh impetus to the economic plan she unveiled last week.

“The good news is that pressures are easing, especially for consumers. Grocery inflation is now at its lowest level in almost three years, and the economic picture is improving. We have also had events come and go last month, specifically Taylor Swift’s UK leg of her world tour, that will have added some volatility to the overall inflation figure for June.

"With these stripped out of future figures, it is hoped that even if we do get another uptick in inflation in the coming months, the BoE can shake it off quickly and prevent any reassessment of the optimal ceiling for interest rates, and any chance of rates having to be put back up."

Andrew Summers, chief investment officer at Omnis Investments, said: “No smoking gun for an August move. Following speeches from the MPC’s Haskell and Pill last week, the odds of a move from the BoE in August reduced somewhat.

"This dataset is unlikely to turn that around, with the market continuing to focus on the meeting after, in September which is pretty much priced for a 25bps cut. It occurs after the US FOMC meets and is priced to deliver their first cut. Investors appear to believe that the BoE will want to wait until their US counterparts move first and it’ll take more than today’s data to change that. The 50bps of cuts priced in the UK by the end of this year is probably fair at this juncture but we believe the risks are skewed to more being delivered.”