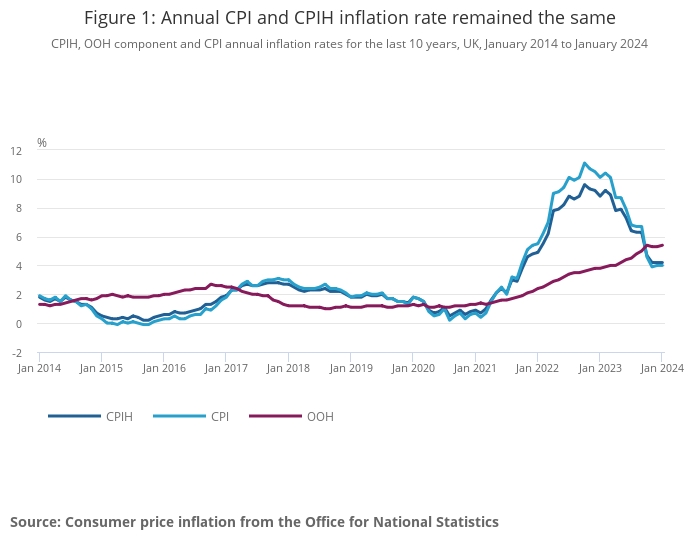

The Consumer Prices Index 12 month rate held steady in January at 4% despite predictions from some of a rise to 4.1% or 4.2%.

ONS figures released today showed that the sister CPIH (Consumer Prices Index including owner occupiers’ housing costs) rose by 4.1% in the 12 months to January, the same rate as December.

CPI showed a surprise 0.1% rise last month to 4% despite experts predicting a fall to 3.8%.

The figures suggest inflation is far from under control although many experts expect falls in the spring.

The main factors driving both the CPIH and CPI annual rates came from housing and household services, mainly due to higher gas and electricity charges. The biggest downward factors came from furniture and household goods and food and non-alcoholic beverages.

There are signs food inflation is on the decline.

On a monthly basis, CPI fell by 0.6% in January 2024, the same rate as in January 2023.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 5.1% in the 12 months to January 2024, down from 5.2% in December 2023. Core CPI (excluding energy, food, alcohol and tobacco) rose by 5.1% in the 12 months to January 2024, the same rate as in December 2023 while the CPI services annual rate increased from 6.4% to 6.5%.

The older Retail Prices Index measure dropped from 4% in December to 3.8% in January.

Industry experts said the figures suggested the route to lower inflation, in line with the Bank of England’s 2% target, would be an uncertain one.

Lindsay James, investment strategist at Quilter Investors, said: “Following what had been a period of steadily declining inflation, this morning’s data from the ONS reveals the UK saw another pause in the pattern of headline disinflation, with CPI at 4%, the same rate as in December 2023 and still double the Bank of England’s target.

“Higher gas and electricity prices lead the way as the primary driver of this uptick, with energy prices in January 2024 reported to be 18% lower than at the peak in January 2023, but 89% higher than in January 2021. However, this is in line with prior expectations and with the energy price cap set to decline in April, this should set the stage for headline inflation to decline more substantially in coming months.

“Core inflation, excluding energy, food, alcohol and tobacco, has been falling considerably slower than the headline rate, and progress here also appears to have stalled. It held steady at 5.1% in November and December, and once again refused to budge in January, driven in part by strong services inflation which rose from 6.4% to 6.5%. That said, the month-on-month data is more encouraging, and so this is unlikely to sway the Bank of England from its recent suggestion that interest rates have peaked.

“Yesterday’s UK labour market statistics revealed a further fall in wages, with annual growth in regular earnings (excluding bonuses) decreasing to 6.2% in October to December, down from 6.6% in the prior three-month period. However, while on the face of it this seems high, annualising the pattern over the past three months indicates that this is now falling quite quickly, with the annualised nominal growth rate of regular earnings running at 2.2% - rapidly nearing the Bank of England’s target and providing a little reassurance that this inflationary pulse is weakening.

“What’s more, tomorrow’s GDP data is widely anticipated to reveal the UK fell into a recession at the end of last year. Though Andrew Bailey has pushed back with an expectation that it will be both shallow and short lived, pressure on the Bank to cut rates sooner rather than later will no doubt continue and today’s CPI data release will do very little to change that.”

Danny Vassiliades, partner at XPS Pensions Group, said: “Today’s announcement that annual CPI inflation remained at 4% in the year to January 2024 shows that the route to lower inflation and lower interest rates remains uncertain. Consensus forecasts are also expecting tomorrow’s GDP estimates to show that the UK was in technical recession during the second half of 2023, having experienced two successive quarters of negative growth.

“Whilst these announcements show that pension scheme trustees should continue to monitor sponsor covenants and scheme funding levels, there is reason to be hopeful that monetary policy will soon see inflation decrease. Despite possible inflationary pressures from the current volatile geopolitical environment, expectations remain that CPI inflation will start falling towards the Bank of England’s 2% target later this year and that Bank base rate cuts are on the horizon.”

Hetal Mehta, head of economic research at wealth manager St. James’s Place, said: “UK inflation moved sideways in January. Whilst the uptick that economists were expecting was avoided, it still remains at double the Bank of England’s 2% target. What will still be concerning the BoE is the stickiness of services inflation, especially as it comes on the back of strong wage growth. But compared to big upside surprise in US inflation yesterday, today’s UK numbers come as slight relief in relative terms.”