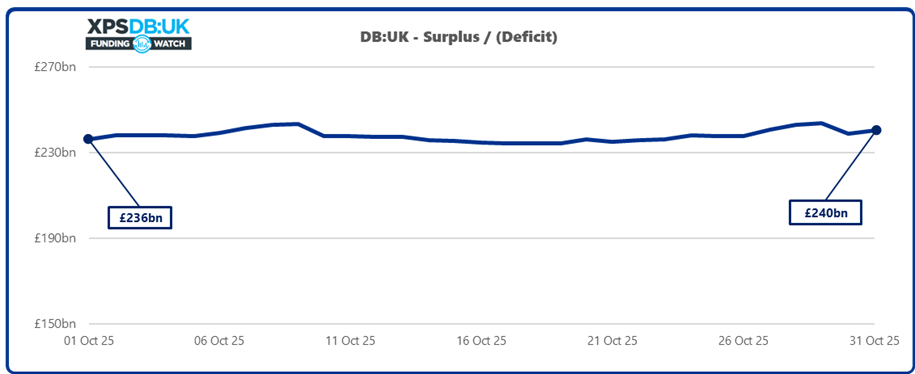

DB pension surpluses remain at record highs, up £57bn year-on-year in October, according to new analysis from XPS Group.

It estimates UK DB pension schemes maintained a £240bn aggregate surplus against long-term funding targets, up £4bn in October and £57bn year-on-year.

It said aggregate scheme assets increased over October, as matching assets rose in value as bond yields decreased. Growth assets, such as global equities, also displayed positive performance.

Aggregate scheme liabilities also increased, driven by a reduction in gilt yields, said XPS.

UK pension schemes maintained strong funding positions throughout October, relative to long-term funding targets. With aggregate assets totalling £1,207bn and liabilities of £967bn, schemes achieved a record funding level of 125% of the long-term target value of liabilities, as at 31 October.

Source: XPS DB:UK

Jill Fletcher, senior consultant at XPS Group said: “Funding levels of UK defined benefit (DB) pension schemes remained strong throughout October 2025 supported by widespread hedging against gilt yield movements which protected long-term funding positions, and kept long-term strategies on course, as gilt yields fell.”

XPS DB:UK tracks the funding position of UK DB pension schemes on long-term funding target and buyout bases, allowing trustees and corporate sponsors to see how their scheme’s funding compares to the wider pensions landscape. The model was refreshed and relaunched in July to take account of published information from the Pensions Regulator and Pensions Protection Fund and insight from XPS’s Member Analytics and the XPS Data Pool.

XPS DB:UK Funding Watch monitors the combined deficit and funding level of UK DB pension schemes on a long-term target basis, using a discount rate of Gilts +0.5% and XPS’s in-house buyout basis.