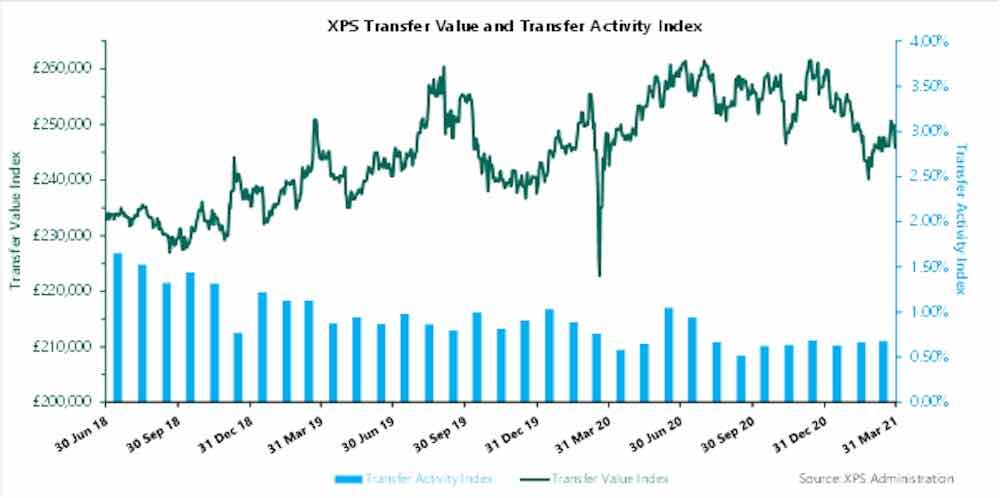

DB pension transfer values recovered in March after dipping in February, according to the monthly XPS Transfer Watch.

Expectations of rising inflation this year caused DB transfer values to rebound, the pension consultant said.

Transfer values recovered about one-third of the sharp fall they experienced in February. According to XPS this was due to “rising expectations” of future inflation increasing the expected value of members pensions.

The average estimated transfer value for a 64-year-old with a pension of £10,000 a year rose from £242,000 in February to £246,000 in March.

XPS says that while transfer values have improved and red flag warnings declined the transfer sector continues to have problems with scam attempts and poor practice.

The Transfer Activity Index, monitoring transfer activity, remained steady suggesting no major changes to the number of transfers and the Red Flag Index, a warning sign of transfer scam signals, showed a small decline with one or more flags identified in just over half of transfers processed in March.

Despite the recent drop in red flag warnings they remain higher than pre-pandemic.

XPS Pension Group’s Transfer Watch monitors how market developments are affecting transfer values for a typical pension scheme member. XPS uses data from the large number of pension schemes it advises. It monitors how many members are choosing to take a transfer from their DB pension scheme and, through its Red Flag Index, the incidence of scam red flags identified at the point of transfer.

XPS says a significant transfer event in March was the publication of the Financial Conduct Authority’s long-awaited final guidance for firms advising on pension transfers, setting out expectations and highlighting examples of poor practice. The FCA has also published a joint guide with the Pensions Regulator (TPR) for employers and trustees looking to support members without straying into advice.

Mark Barlow, partner, XPS Pensions Group, said: “The joint guide from the FCA and TPR provides welcome clarity for the many schemes who want to help their members when they’re considering a life-changing decision like whether to transfer their pension. It is particularly helpful to see the guide acknowledging the valuable role that employers and trustees can play in supporting members in accessing high quality financial advice.”

Helen Cavanagh, consultant, XPS Pensions Group added: “We are pleased to see the continued fall in the Red Flag Index. However, more than half of cases are still showing warning signs that could indicate a scam, or at the very least, the potential for poor member outcomes. This remains much higher than the level of red flags we were seeing before the pandemic.”

"Our scam protection service is identifying many cases which are described as being ‘poor practice’ in the new FCA guidance. We are also seeing that the additional disclosure requirements introduced last year are not being met by some advisers, and we hope that this guidance will help to increase standards.”

The XPS Pensions Group’s Transfer Value Index shows the estimated Cash Transfer Value of a 64-year-old member with a pension of £10,000 a year with typical inflation increases. XPS estimates that approximately 50,000 DB members leave their schemes each year.