Advisers says DFMs are failing in many key areas in a highly critical assessment of their performance.

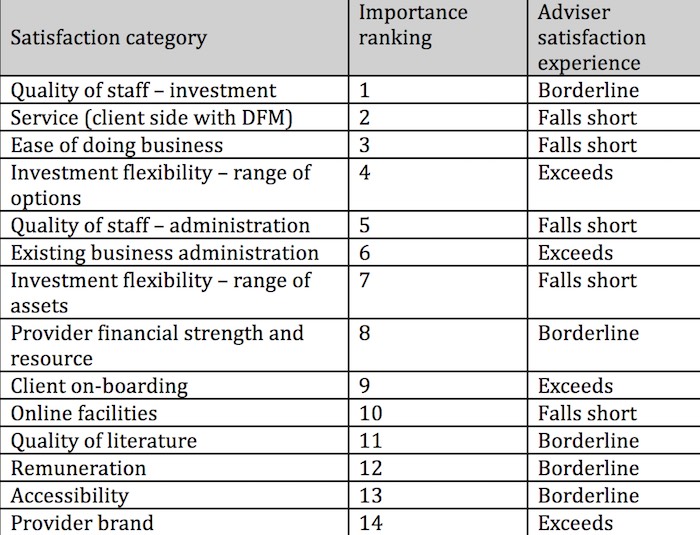

Discretionary Fund Managers are either failing to satisfy or only borderline in 10 out of 14 crucial aspects of their service.

They have fallen short in two of the three categories rated by advisers as most important: Service, on the client side with the DFM and ease of doing business.

The findings come in a Defaqto review.

Related: New DFM tables for Financial Planners released (turn to page 33)

Defaqto’s service satisfaction survey asked advisers to rate DFMs in relation to the importance of 14 categories, ranked the quality of staff at the DFM the most important aspect of service (1st and 5th), in spite of the progression of technology.

Once the importance of each service category was rated, advisers were asked to rate their own experience with DFMs and then the results were plotted, identifying gaps in satisfaction experience.

The report stated: “Reliance on personal contacts to help with any issues ranks highly, indicating that that the industry is very much based on relationships and professional interaction.

“Of the top 3 most important, 2 fall short of expectation and 1 is borderline which is surprising because in whole, or part, they rely on personal relationships.

“‘Service’ to the client, as judged by the adviser, unsurprisingly ranks second in importance.

“If the client is content with the service they are getting from the DFM, perhaps enhanced by the adviser, this can only improve the adviser/client relationship. Advisers may understand and forgive any rare lapse in service, but clients may not be so accommodating.

“The success of an adviser depends on their personal relationship with their clients. These results underline that advisers also expect their personal relationships with product and service providers to enhance their overall investment proposition.”

Pan Andreas, head of insight and consulting for funds and DFM at Defaqto, said: “The combination of an adviser, expert at financial planning, and a specialist investment manager, a DFM, can provide value to a client as portfolio investments are constantly monitored and managed within agreed risk parameters.

“However, if the value of the DFM falls short in the eyes of the adviser there are alternatives: Another DFM, an alternative solution such as an advisory portfolio management, multi-manager or multi-asset funds.

“Discretionary firms that are looking to improve satisfaction with their clients and the advisers that represent them, would benefit from applying resource to the satisfaction disciplines that are most important to advisers.”