The number of UK active equity funds failing to beat their benchmarks has increased fourfold over the past year, according to a new report from data provider S&P.

The data is likely to put more pressure on active fund managers to justify their fees against a backdrop of many active funds underperforming, a recent hot topic in the advice sector.

The report found that 87% of UK active equity funds failed to beat their benchmark over the past year and poor performance among European active equity funds against the benchmark continues. Underperformance was substantially higher in actively managed Global Equity, US Equity and Emerging Market Equity funds.

The year end SPIVA report (S&P Indices Versus Active Funds) found that the benchmark outperformed many UK equity funds:

o Nearly nine out of ten UK active equity funds underperformed the benchmark over one year, with 87.22% of funds underperforming the S&P United Kingdom BMI. This is a four-fold increase on calendar year 2015 when less than a quarter (22.2%) of funds underperformed.

o UK actively-managed equity funds fared poorly over all time horizons, with 61.64% of funds underperforming over three years, 50.0% over five years and 74.19% over ten.

o Average UK active equity fund performance also lagged the benchmark over one year, with active funds delivering an average annual return of 11.15%, which is 5.95% less than the S&P United Kingdom BMI over the same period.

Some of the worst underperformance was seen in the emerging markets sector where 100% of active emerging markets equity funds failed to beat the benchmark over 10 years:

o Emerging Market equity funds badly underperformed the benchmark over all time periods, with every single fund underperforming over a ten year time period. 93.62% of funds underperformed the S&P/IFCI over the last year. Underperformance rose to 98.17% over five years.

o 98.45% of actively managed Global equity funds underperformed the S&P Global 1200 in the past year. Over the last year, 88.52% of active global equity funds underperformed.

o 77.20% of actively managed US equity funds underperformed the S&P 500 in the year to 31 December 2016, with 97.91% underperforming over ten years.

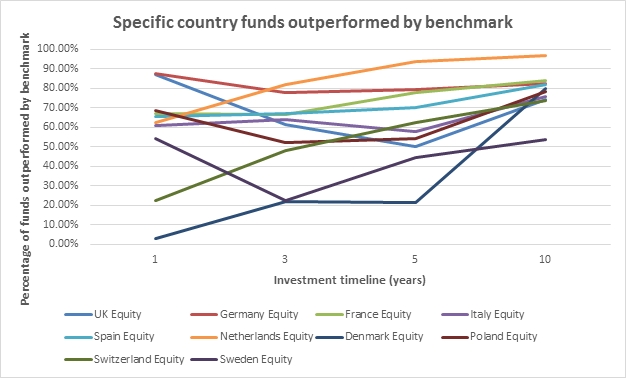

88% of active European equity funds underperformed the S&P Europe 350 over ten years:

o Almost nine in ten euro-denominated actively managed European equity funds underperformed the benchmark over 10 years, with 88.25% failing to do so.

o Over all time horizons, the majority of European active equity funds lagged the benchmark, with 80.41%, 73.64% and 74.17% of funds underperforming over one, three and five years respectively.

The Year-End 2016 Europe S&P Indices Versus Active Funds (SPIVA) Scorecard provides a breakdown of performance of actively managed funds against their relevant S&P benchmarks and ten-year data ending 31 December 2016.