Financial Planning fintech Dynamic Planner has today launched a new cashflow modelling tool.

The tool joins an increasingly crowded cashflow modelling market with rival cashflow tools from Prestwood, CashCalc, Voyant and others.

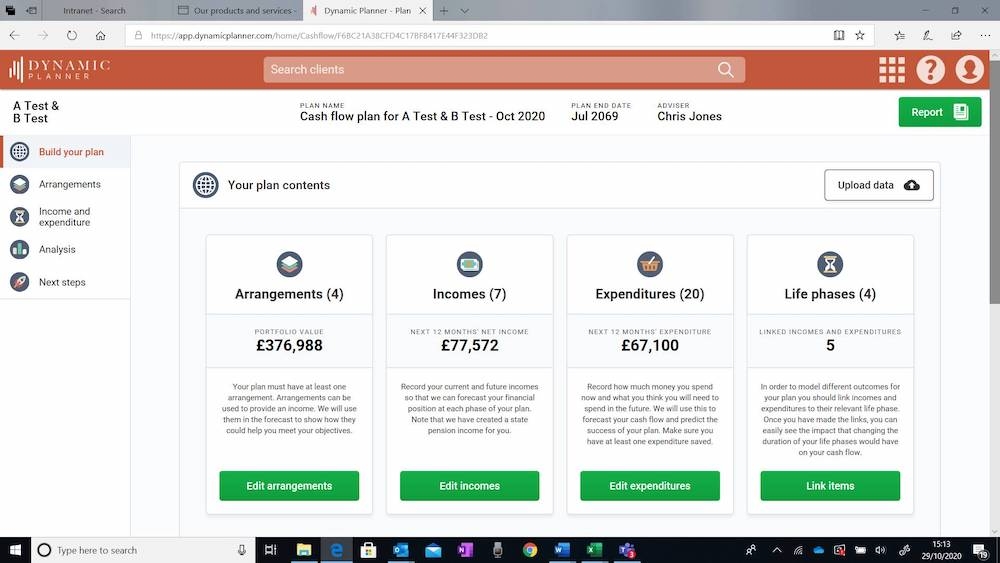

Dynamic Planner says it’s new ‘Cash flow’ tool offers planners comprehensive integration with other Dynamic Planner tools and services and helps cut the risk of ‘miscalibration’ when different inputs from different sources are used.

Dynamic Planner’s Cash flow combines cashflow modelling with an independent ‘asset risk’ model using real-time Monte Carlo modelling of risk-based cashflows calculated on a monthly not an annual basis. Dynamic Planner says this is “critical” for clients who are in decumulation.

Using the tool advice firms can link a client and their portfolio’s risk profile to their cashflow plan. This avoids having to decide on and manually enter growth assumptions, the firm says. Dynamic Planner says this should more accurately project what a client’s future looks like and more robustly tests their capacity for risk.

Ben Goss, Dynamic Planner chief executive, said: “The impact of Covid, Brexit and everything in between has catapulted the ability to provide solid, robust, and risk-based cashflow planning for all clients to the top of advice firms’ wish lists.

“At the heart of what advisers told us they needed, was to clearly show that they were working hand in glove with the FCA’s stance on demonstrating suitability. Using our Cash flow enables them to do this through our asset risk model, in combination with real-time, risk-based cashflows.”