Aviva has found that only 38 per cent of workers are actively contributing to a workplace pension, despite over half having access to one.

The firm's second Working Lives survey questioned over 4,000 employees and over 750 employers on their attitudes to employment and pension.

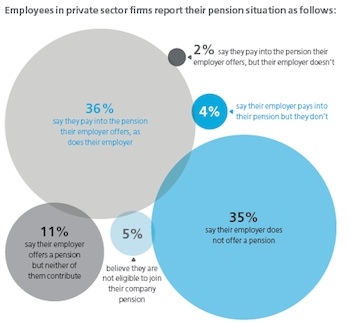

Some 36 per cent said they paid into a workplace pension, as did their employers and two per cent said they paid into a workplace pension but their employer did not. Some four per cent said their employer contributed to a pension but they did not.

Some 35 per cent said their employer did not offer a pension scheme, 11 per cent said neither them or their employer contributed to a pension scheme and five per cent did not believe they were eligible to join their scheme.

{desktop}{/desktop}{mobile}{/mobile}

Of those who were not contributing to a pension, 45 per cent said they could not afford to contribute to a scheme, 19 per cent were paying off debts and 17 per cent were saving for other things. Some 10 per cent said they were too young to think about retirement.

However, the amount of people who said they could not afford to contribute to a scheme had dropped from 55 per cent in 2012.

Looking at regional trends, employees in Northern Ireland contributed the most to their pensions at 6.2 per cent while employers in Scotland contributed the most to their employees' pensions at 7.2 per cent.

The benefits most valued by employers were an annual or performance related bonus, defined contribution pension schemes and health insurance.

Mark Noble, managing director of health and corporate benefits at Aviva, said: "The fact that so many employees say they cannot afford to save for their retirement, and yet there is strong support for auto-enrolment, suggests that employers and the wider industry need to focus on a deeper level of engagement. Employers need to think innovatively about ways of encouraging employees to save, and adopt practical tools that help their workers make decision based on personal circumstances."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.