Customers are finding financial products complex but are still unwilling to use a financial adviser, according to Ernst and Young.

Less than 40 per cent of people would use a financial adviser when choosing life insurance, according to the firms latest report ‘Dawn of an era’.

For the survey, the firm questioned over 24,000 customers across 23 countries.

However, customers had a strong wish for personal interaction as they felt expert assistance would help them make important financial decisions. They also felt they were unsure which products were best for them and felt products were too complicated and technical.

Adam Walton and Emma Morgan, executive director and manager at Ernst and Young, said: “The survey points to a dilemma for customers: they want to take control over the buying process and don’t want to have to rely on someone ‘selling’ to them and yet they feel they have to use an adviser because of the complexity of the purchase.”

When asked how much they would pay for financial advice, 45 per cent said they would not be prepared to pay at all.

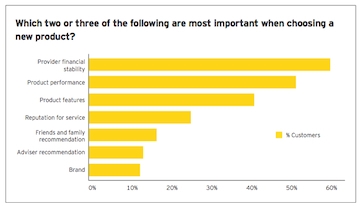

When choosing a new product, the most important factor was the providers’ financial stability followed by product performance. Adviser recommendation was the sixth most important factor.

“Customers are looking for hard, comparable factors like financial stability, product features and performance and adviser recommendation comes a long way down the list.

“This raises a challenge for insurers, particularly in the context of the RDR: how do they respond to customers’ desire to research and compare products, and overcome their resistance to paying for advice?”

Ernst and Young suggested that firms improved their communications and proposition to provide the right data to allow the customer to make a well-informed choice.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.