Former FCA technical specialist turned consultant Rory Percival, a Chartered Financial Planner, has today published his long-awaited guide to risk-profiling tools.

The “Ex-regulator’s guide to risk proofing tools” is an in-depth review of risk profiling tools and Mr Percival says it is the first since the Financial Services Authority (FSA) produced its Finalised Guidance (FG 11/5) in 2011.

The six risk profiling tool providers reviewed are among those most-used by Financial Planners: A2Risk, Dynamic Planner, EValue, FinaMetrica, Morningstar and Oxford Risk.

Mr Percival, a popular industry event speaker and commentator, found that “in general”, the tools have improved since FG 11/5.

Questions and answers have improved, risk descriptions mostly include quantification of risk, and the worst of the scoring anomalies have been addressed.

All tools, however, involve some limitations, he said. These include some tools not having risk descriptions that are quantified, scoring algorithms that don’t always result in the correct result and concerns about asset allocations associated with the risk descriptions.

Addressing risk profiling tools’ limitations is something that will be mandatory for advisers come MiFID II in January 2018. MiFID II states that advisers need to ensure the risk profiling tool they use is ‘fit for purpose’ and that limitations must be identified and actively mitigated through the suitability assessment process.

Mr Percival, a former Financial Planner, said: “In addition to the hard rule that MiFID II introduces that requires advisers to actively mitigate risk tools’ limitations, the FCA remains concerned about advisers’ approach to risk profiling as highlighted in its recent ‘Assessing Suitability Review’ findings. So, this is an important area that advisers need to focus on.”

One of the biggest areas of concern identified in the guide is significant differences in the mapping of asset allocations. Although not required by the regulator, some risk profiling tools include asset allocations as part of the risk category descriptions.

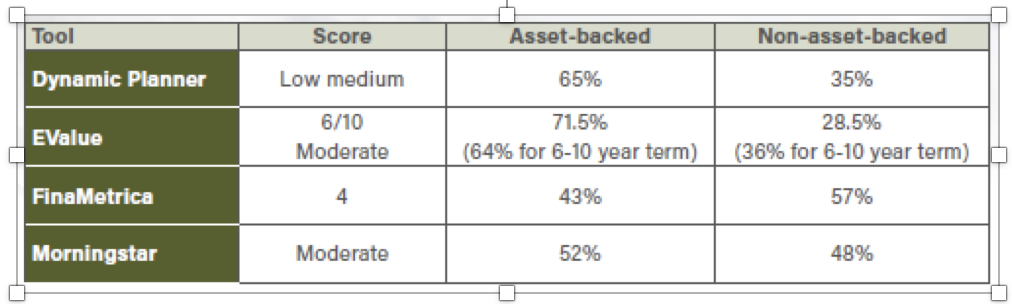

For example, for the same client – exactly in the middle of the range of risk levels – the high-level asset allocations varied significantly:

Note: asset backed is defined as equities and property; non-asset-backed as fixed interest and cash.

Mr Percival said: “My main concern, highlighted in the report, is the variation in the asset allocation mapping between the different tools. In the guide I set out the actions advisers should focus on to ensure the investment solution meets the risk profile of the client.”

Paul Resnik, director of FinaMetrica (one of the risk profiling tools reviewed), said: “We’re pleased that Rory has acknowledged the tools he has assessed have all improved in the intervening years since FG11/5. We also agree with him that all risk profiling tools have limitations and support his sensible guidance on how advisers can go about mitigating those limitations.”

EValue (also reviewed) welcomed the guide but has highlighted that the issue surrounding the use of risk profile questionnaires to map investments and asset allocation needs to be addressed urgently by advisers.

Paul McNamara, chief executive at EValue said: “Risk profiling alone is not enough. Advisers and their clients also need to explore and understand appropriate asset allocation strategies to support suitable recommendations.”

• The guide costs £250 plus VAT (20% discounts available for certain categories of adviser) and aims to help advisers meet the MiFID II requirements. The guide can be purchased at Adviser Store.