Increasing use of income drawdown following the Budget annuity changes could see 20% of pensioners exhausting their funds before they die, pension experts have warned.

Research from Equiniti Paymaster, a pension service provider, found that although the overwhelming view (75% of respondents) was that annuities remain fit for purpose at retirement, respondents (annuity providers and distributors of annuities) were split 50/50 as to whether annuities will remain the product of choice for retirees.

Some 80% agreed, a quarter strongly, that income drawdown products should be a compulsory part of the open market option (OMO) debate with 80% believing that drawdown should be given an equal profile to annuities as alternative retirement products.

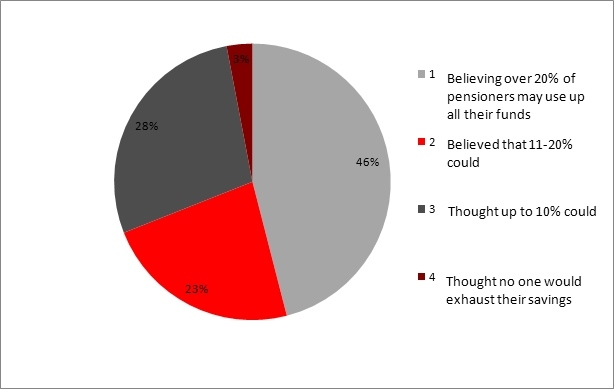

However, many respondents raised concerns that an increased use of drawdown could see pensioners exhausting their retirement funds.

Post-Budget the overwhelming view, 97%, was that the UK would see an increase in the cashing in of small pots for individuals to use for a multitude of purposes. Some 87% thought that as a result of the Budget, more pension savings will be withdrawn as lump sums and used for purposes other than retirement income.

{desktop}{/desktop}{mobile}{/mobile}

Talk of reckless spending, such as buying a Lamborghini, was dismissed by half of the respondents, but 35% were of the view that some people would spend their money recklessly.

A contributing factor, albeit welcomed by 90% of the experts, was the fact that post-Budget pension savings and retirement income vehicles remain tax efficient. Pensioners would be able to access any or all of their retirement funds at their marginal rate of tax as opposed to the current 55% charge for full withdrawals. This could allow further development of new products, says Equiniti.

Suzie Rudzitis, managing director, Pension Services Division at Equiniti, said: " Our 2014 survey saw 40+ of the most influential people in the annuity market share their views of the changes required following the Chancellors spring Budget. It is clear that a radical rethink is already happening."

The survey was carried out in March. There were 44 respondents and the question set was only asked of annuity providers and key distributors of annuities. It was conducted as an online questionnaire emailed to providers and supported by a telephone follow up.