Standard Life believes auto-escalation could add £13bn-£14bn to auto-enrolment if it was implemented after the 2017 review.

In its ‘Keep on Nudging’ report into auto-enrolment, the firm said auto-escalation would help employee increase their pension contributions over time.

Auto-escalation is when an employee’s pension contribution increases automatically at set times or milestones and is a successful scheme in America.

For a 16-24 year old, Standard Life says auto-escalation could increase their pension savings by £85,000.

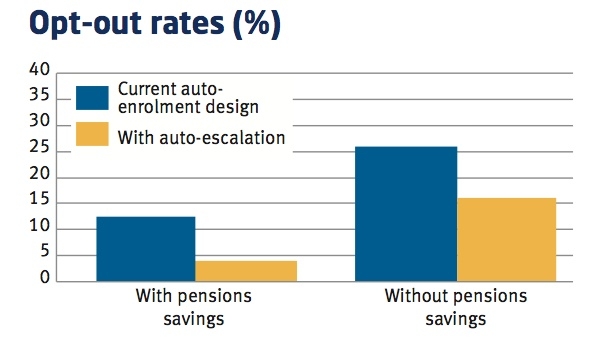

It also found that less people would opt-out of a scheme which introduced auto-escalation as it reduced the need for them to make any further decisions later in life.

Furthermore, 31 per cent of people would be willing to make additional voluntary contributions to the scheme.

This could add up additional annual retirement savings of £13bn by 2025.

The firm also suggested parallel saving would add a similar amount.

Parallel saving is a method for medium to long-term saving through two per cent of salary being paid into a workplace Isas alongside a pension scheme.

However, it was found that if employees were willing to pay into an Isa scheme, they were less willing to contribute more than four per cent into their pension scheme.

David Nish, chief executive of Standard Life, said the two options are worthy of further investigation.

He said: “We need to be thinking about the future development of auto-enrolment, about the next nudge. We tested two possible ‘extensions’ to auto-enrolment and found that they too could have high levels of take-up.

“Either of these extensions to auto-enrolment could potentially add £13-14bn in retirement savings annually by 2025, over and above the £12.5bn we expect from auto-enrolment alone."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.