Some trading apps lack adequate checks and this could leave consumers exposed to unnecessary risks, the FCA has warned after a review of the sector.

The review assessed the business models, product offerings and services of 12 trading app firms, identifying both positive practices and areas needing improvement.

Apps, often run on mobile devices, have become increasingly widely used in the investment sector.

The regulator said: “While some firms had strong processes for assessing customer understanding of high-risk investments, others lacked adequate checks, potentially exposing consumers to unnecessary risks.”

The FCA said that meant some products were potentially being distributed to customers outside the target market.

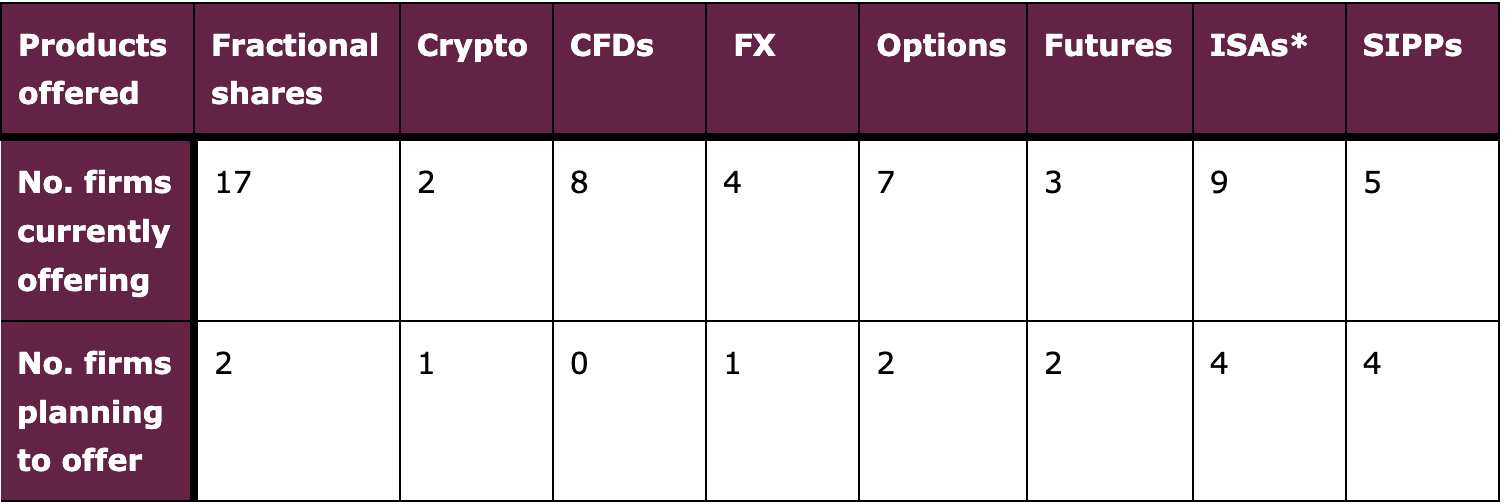

The main investments offered by the firms at the time of survey completion included fractional shares, ISAs, CFDs, Options, SIPPs, FX, Furtures and Crypto (see table below).

The FCA said 11 firms had plans to introduce new products in the future.

Source: FCA

The watchdog warned firms they must fully understand their obligations as manufacturers and distributors, as set out in the FCA’s rules.

It also said some firms may need to reassess whether their current pricing structures provide good value for consumers.

The FCA said: “We urge firms to consider these findings when designing trading apps and improving consumer protection practices.”

Data from the FCA’s Financial Lives 2024 survey showed 3% of adults (1.6m) were using a trading app, with use higher among men (5%) than women (1%). Almost half (47%) of trading app users were aged 18 to 34, while just one-sixth (18%) were 55 or older.

The regulator said trading apps, commonly known as 'neo-brokers', have allowed more retail investors easier access to a wider range of investments. It is a growing sector. New firms have entered the market while traditional investment brokers, such as Hargreaves Lansdown, have also introduced trading apps.

The FCA said: “Where firms are diversifying and growing, we want them to do so in a sustainable way, while supporting innovation and growth, and helping consumers to navigate their financial lives. To manage this, firms need appropriate oversight and controls to build trust in the sector.

“We want to see a consumer investments market where everyone can make well-informed investment decisions, understanding how they meet their needs and the risks they are taking.”