The Financial Conduct Authority has warned clients of failed SIPP firm Hartley Pensions to be wary of scams or fraudsters as administrators of the collapsed provider begin to send out information about the transfer out process.

In a statement the regulator said: “We understand the joint administrators are beginning to issue asset statements and communications to clients informing them of the next steps.”

The FCA added: “Hartley clients should ensure they are communicating with the correct parties concerning the transfer of their pension scheme, as there could be a heightened risk of scams or fraud at this time.”

Hartley Pensions was a SIPP operator authorised and regulated by the FCA.

It also provided administration for a small number of Small Self-Administered Schemes regulated by The Pensions Regulator.

Hartley Pensions went into administration in July 2022 after several regulatory interventions and a failure to find a buyer. An estimated 16,000 clients were hit by the collapse.

It had been subject to a number of FCA requirements in early 2022 due to, “serious operational, financial and regulatory issues.” As a result of the issues, the FCA requested that the firm go into an insolvency process in the interest of clients.

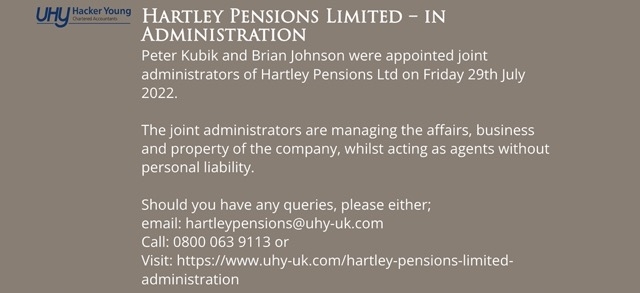

The firm then sought professional insolvency advice and, as a result, a director determined that it was insolvent and took steps to place it into administration with Peter Kubik and Brian Johnson of UHY Hacker Young LLP appointed as joint administrators.

In previous years, Hartley Pensions had acquired the client books of several failed SIPP providers. It bought the Guinness Mahon book in February 2020 after the firm collapsed. The deal meant the transfer of 4,000 SIPPs previously administered by GMTC which suffered a string of problems and legal actions from unhappy clients.

Other SIPP books the firm acquired in recent years included GPC, Berkeley Burke SIPP and Greyfriars AM.

The Financial Services Compensation Scheme (FSCS) declared Hartley Pensions in default in February.

The compensation body said it had placed Hartley in default in order to be able to pay compensation to ex-clients for exit charges.

The U-turn came about after the FSCS, “obtained and considered further evidence,” it said.