I am not sure that I have ever posed this question to any of my clients: “Do you trust me?”It’s a given. It is implicit in all our dealings with each other and has been since the day we opened the doors in May 2000.

We have a Mark Twain quote on the opening page of our website which reads, “always do what is right.” This will surprise some people and astonish the rest. This simple little statement fascinates me as much today as it did when I first read it over a decade ago.

With this basic question though the reality of today is that, if asked, people the world over are far more likely to raise eyebrows suspiciously and click their trust senses into reverse. If you have to say it, or ask, the assumption is that it isn’t there. This is a very sorry state of affairs indeed.

It seems incredulous that as 2012 opens, ‘mistrust’ still provides the starting point for many in the industry. This presents both a huge challenge and opportunity to regain consumer trust in a sector whose very foundations rest upon the strength of its’ future promise.

Set against a landscape fraught with other challenges and difficulties in the run up to the RDR, the scale of this single issue is of such importance that it simply can’t be ignored by anyone serious about a future in the sector.

At its starkest it appears that nobody trusts anybody anymore and that has to be wrong. Governments don’t trust other governments, banks don’t trust other banks, the public doesn’t trust financial institutions and there is an industry stand-off between the regulator and market participants. As much as we all worry about a run on banks there has been a much more damaging run on trust in financial matters building up over a number of years.

Forced versus Active Trust

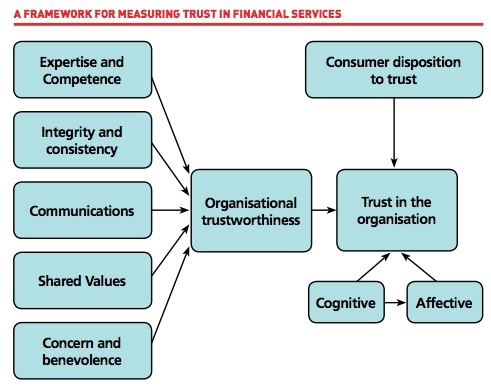

In studying trust and trust related issues over the past year or so, I have found myself in dialogue with key academics, such as Prof Christine Ennew of Nottingham University, one of the individuals responsible for research into issues of trust in relation to financial services organisations and delivering a key industry metric, the financial services trust index. The index tracks how financial services organisations are trusted in relation to others, such as say supermarkets or the BBC, and provides some very interesting insights.

One such insight is, ask people if they trust “their bank” and they say “yes”. Ask them if they trust banks and there is a resounding “no!” People have to trust their banks in simply having to own and operate a bank account but do not trust banks and financial institutions in general.

A significant number of customers have faith in their financial providers only because they feel they have no choice. Some organisations effectively survive on their reputations alone amid a lack of consumer trust in the people who run them. There is a forced trust versus active trust phenomena that exists. The study concludes that ‘brokers or others’ as they term them in the equivalent US study from Chicago Booth University, see that Financial Planners or IFAs score much higher in the trust stakes and it is this trust imperative that we seek to understand more fully and work to build greater levels of active trust through on-going study and enquiry.

Forced trust must be converted to, or at the very least run alongside, ‘active trust’-based first principles such as utmost good faith and my word is my bond. For the professional Financial Planner their businesses have always acted with simple and trusted fundamentals at the core. So much of the industry however, has been built up pushing product and chasing investment returns without sight of what clients actually need. Money must be managed forwards not backwards and this has to be regularly stress tested as an adviser/ client partnership, something so evident in the integrity of Financial Planning process itself.

Enough is enough

John C Bogle’s book ‘Enough’ provides additional insights into the whole process of managing money and the relationship between adviser and client. Mr Bogle, as many of you will know, was the founder and former chief executive of Vanguard.

The book starts by quoting Joseph Heller (the famous author of Catch 22) stating to a friend at a society gathering that he was not in any way envious of their host, a billionaire hedge fund manager, as he possessed something the said individual would never have, which was “enough.” Mr Bogle was stunned by the “simple eloquence of the word” and lamented that “for a critical element of our society... there seems to be no limit today on what enough actually entails”.

Later in the book Mr Bogle quotes Daedalus - the feted journal of the American Academy of Arts and Sciences - stating:

“The Primary feature of any profession (is) to serve responsibly, selflessly, and wisely...and to establish (an) inherently ethical relationship between the professional and general society”

Mr Bogle’s modus operandi shines through early on in Enough - “It is essential that we demand that the financial sector function far more effectively in the public interest and in the interests of investors than it does today.”

Enough indeed

I believe businesses get the behaviours they reward. Most if not all businesses are there to make a profit but profit at all costs is not always good profit. A free market system without morals is no free market at all.

Too much history of the financial sector has been based on ‘making the sale’, often at the expense of its’ consumers. The ‘trust’ element has broken down to such an extent that investors are confused and don’t know where to turn next, a perilous and unnecessary state. This is the fundamental problem that needs fixing. Mr Bogle points to the fact that reward structures in our industry are flawed. They have damaged and undermined confidence in the sector and we need to regroup our efforts if we are to see things change for the better.

Regulatory Role

In my view, to really get to grips with this problem we must all revisit our practices, processes and systems. The regulator is closely scrutinised in all of its work. Where it has fallen short corrective measures must be put in place. The need for developed regulation is an industry failing. The consumer must be protected. Any failure in this protection manifests itself by the regulator making its presence felt by sending very clear messages out to market participants through high profile initiatives, dispensing industry fines and making an example of organisations who fail in their regulatory responsibilities. Is that an acceptable position? Why have that position at all?

Of course it is imperative that we have a regulator and a regulated market. Our regulator must be supported by all participants:

a) To build better outcomes for consumers

b) Build market confidence in the financial system itself

Without that industry unity, ‘corrective actions’ in the market are counter-productive in that they actually destroy trust and confidence in the financial system. We have an industry and a regulator that need to work well together, understand root issues and have a common goal in delivering first class Financial Planning.

The Trust Path

So what can we do as an industry to change all of this? The last thing we need is a glib half- hearted ‘initiative’ that sounds idealistic and has little impact. We can’t change the past but we can shape the future and turn our industry into a true profession, centred on delivering better outcomes for the consumers of our products and services and society at large. Turning again to Mr Bogle he states that: “We need to find ways to radically improve our nation’s system of capital formation, through some combination of education, disclosure, regulation, and structural and legal formation.” It needs to be radical, it does not involve any one individual or company, body or government, and it really must involve us all. There is a required industry shift in building greater levels of trust, loyalty and engagement - a depth of understanding consumers real needs through tools such as greater levels of emotional intelligence, sound planning methodology and accreditation of Financial Planning firms and standards.

There are three key drivers for change: operational excellence, service innovation and client intimacy.

Trust is a valuable business asset that people will pay for and we should understand this. With the financial sector delivering near 10 per cent of our GDP these days and growing this is a very important part of our output as a nation and needs to be recognised as such. On the world stage we have always been seen as a place where you can do business with people with honesty and integrity - the strength of a handshake mattered and still does. Like it or not, however, we are an industry not without scandal and this must change. Shallow attempts by business to ‘dress-up’ the trust imperative (through such as corporate governance initiatives) will only make matters worse. We need a humble industry response and root-cause action, coupled with strength of leadership and taking the long-view to change things for the better. Through the Institute of Financial Planning it is the intention to conduct research into what drives active trust through all our relationships and build industry metrics and tools for financial services organisations to stress-test the credibility of their offerings through tools, helps and guides to take them through this process.

Ultimately, as a Financial Planning profession and a wider financial services industry we must deliver metrics that look both inside out in terms of the integrity of a firms operating processes, its systems and its people and outside in terms of how consumers view and engage with our firms, all centred on the prize of turning our industry into the profession it truly deserves to be. Enough is just the starting point.