The gap between male and female savings has narrowed by £2,750 over the past year, according to HSBC.

The firm said women's accounts had risen by £1,775 while men's had fallen by £969.

However, men still had significantly more saved than women with an average savings pot of £23,724 compared to £13,746 for women.

Some 40 per cent of people said they were now putting away a regular sum of money each month compared to 28 per cent in 2011.

Women were better than men at retaining their savings with 25 per cent of women withdrawing less than they had saved compared to 22 per cent of men.

{desktop}{/desktop}{mobile}{/mobile}

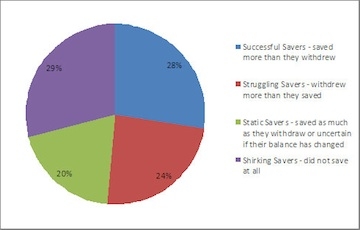

Over half of savers said their savings habits were not affected by low interest rates with the majority of savers keeping their money in deposit accounts. However, some 29 per cent of people said they did not save anything at all.

The most popular reasons for saving money were to use for a rainy day fund or for a short-term goal such as a new car.

Bruno Genovese, head of savings at HSBC, said: "It is still a tough environment for savers so it is encouraging to see an increase in those managing to build their balances.

"However, the findings show that many people are still struggling to save money and not touch it. Last year, a quarter of savers had to dip into their savings pot and withdraw more than they saved. Setting realistic goals and having a portfolio of savings to achieve short, medium and long term goals is key to building up a nest egg."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.