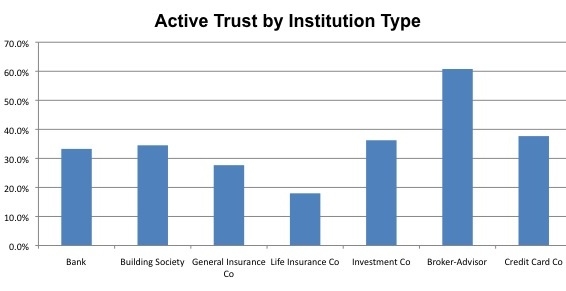

The study of over 15,000 consumers by the Financial Services Research Forum found consumers recorded the highest levels of trust for brokers and advisers.

The study looked at active and forced trust and found brokers and advisers were actively trusted by over 60 per cent of consumers.

This compared to life insurance companies who were trusted by less than 20 per cent and banks who were trusted by less than 35 per cent of consumers.

Nick Cann, chief executive of the Institute of Financial Planning, said: "Professional Financial Planners demonstrate trust because by the very nature of their service they are sitting on the same side of the table as the client and working on medium and long term goals with them.

"The Financial Planner brings expertise, experience and professionalism underpinned by the Code of Ethics and Practice Standards, sets out what they can and cannot do and expects to work with the client for the long term.

"Most spend the first few hours of the relationship not talking about products at all but establishing rapport and ensuring they are able to actually help and add value to the client."

He cited the Accredited Financial Planning FirmsTM register as action the IFP was taking to increase standards in the industry. This register, established last October by the IFP, recognises the best Financial Planning firms nationwide.

He also said the necessary qualifications required to be a Financial Planner demonstrated to consumers they were able to apply knowledge and skills to deliver true Financial Planning.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.