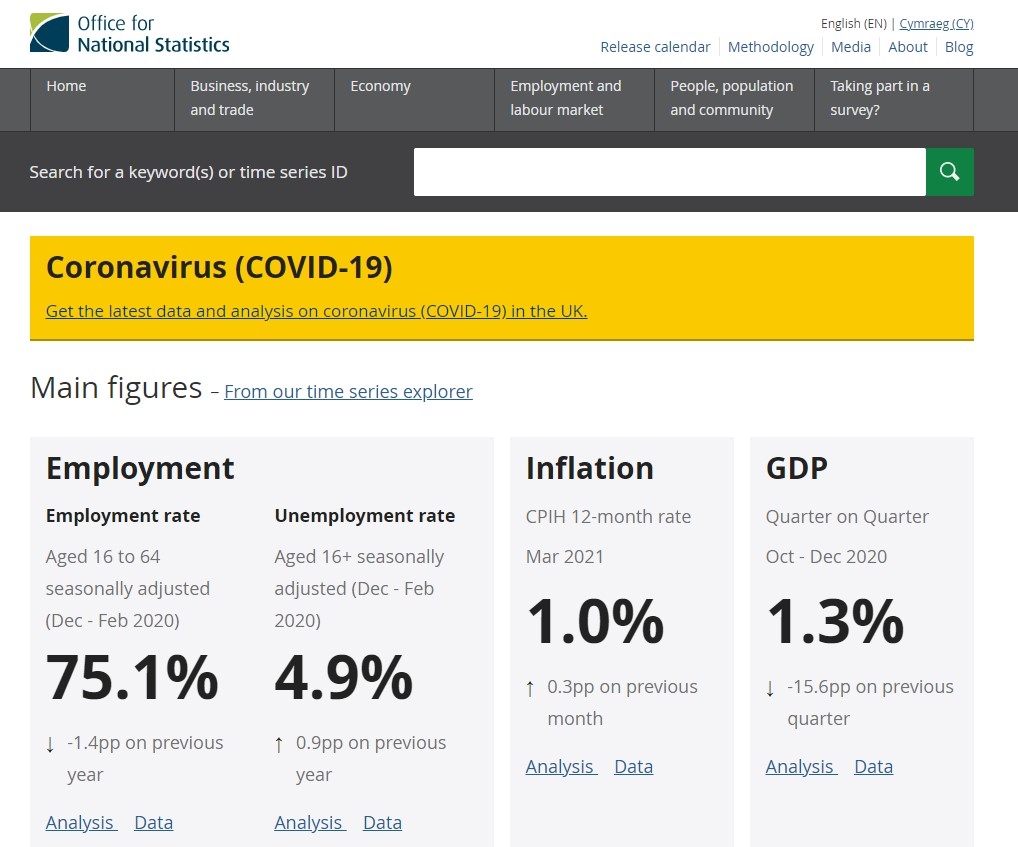

Whilst the latest data from the Office for National Statistics (ONS) shows auto-enrolment has boosted workplace pension participation, it has also shown that most are not saving enough for retirement, according to Financial Planners.

The Financial Conduct Authority has finalised new rules requiring listed firms to disclose progress against diversity targets.

Financial Planning and wealth management firm Quilter saw assets under management and administration fall 4% over the first quarter to £107.2bn.

Investment manager and adviser support services provider Tatton Asset Management is to acquire 50% of DFM 8AM Global for £7m.

IntegraFin Holdings, the parent company of adviser platform Transact, has reported a 1.9% drop in funds under direction in its second quarter as global markets took a tumble.

Schroders Personal Wealth (SPW), the Financial Planning joint venture run by Schroders and Lloyds Bank, has partnered with charity Groundwork to create a tailored financial training programme.

Jamie Lowe, director and Financial Planner at True Self Wealth, has shared with Financial Planning Today what inspired him to set up a new Financial Planning firm focused on LGBTQ+ clients after transitioning gender to become a trans person.

All clients considering taking out an equity release plan are now required to have at least one face-to-face meeting in person with a solicitor before going ahead.

Adviser network Tenet has appointed two regional business managers to introduce new firms and advisers to the network.

The number of higher rate taxpayers in the UK is set to increase 65% over the next four years from 4.1m to 6.8m, according to the latest figures from the Office for Budget Responsibility (OBR).