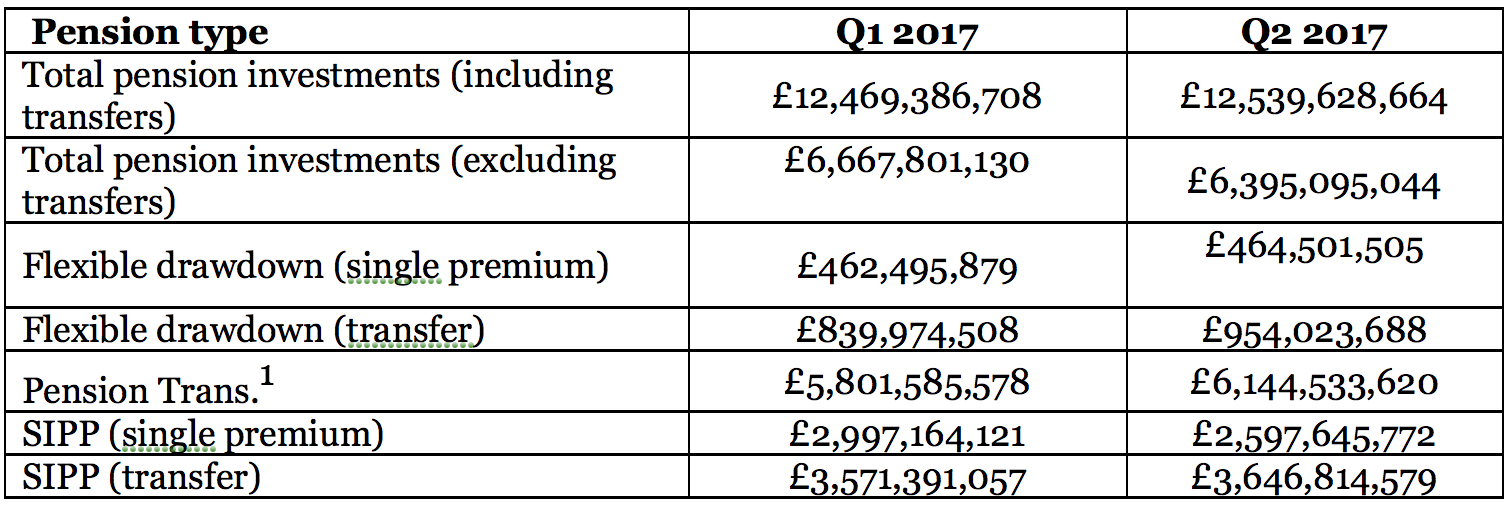

The boom in pension transfers is set to continue with news that flexible drawdown pension transfers surged by 13.6% (£114m) in the second quarter of this year to reach £954m.

Despite the boom, new pension investments fell by 4% and total SIPP sales (excluding transfers) dropped by over 13% during the quarter.

Analysis from Equifax Touchstone, an intermediary database provider, showed that transfers across all products rose by 5.9% to £6.1 billion, including a £75.4 million (2.1%) increase in SIPP transfer sales. The company says the increase highlights the trend among investors to look for pension products that “better suit” their retirement needs.

According to the data, which covers more than 90% of the UK’s leading life and pensions companies, total pension investments, including transfers, reached £12.5 billion in Q2 2017, a small gain of 0.6% on the previous quarter.

Sales for 2017 are on trend to exceed 2016, with inflows for the quarter (including transfers) up £4.1 billion (47.8%) year on year.

Despite positive quarterly and year on year net inflows, new pension investments declined by 4.1% (£272.7 million) and total SIPP sales (excluding transfers) were down on Q1 2017 by 13.3% (£399.5 million).

John Driscoll, director at Equifax Touchstone, said: “The Q2 2017 data has remained extremely positive overall, building from an exceptionally strong Q1 performance with significant rises in drawdown transfers. Encouragingly pension inflows have grown once again despite ongoing political and market uncertainty, showing resilience within the UK pension sector.

“Looking ahead to the third quarter, we expect high volumes of pension transfers to continue, particularly from defined benefit schemes to drawdown products, where a number of providers have seen record interest.

“Defined benefit schemes are currently offering members improved transfer values in an attempt to shift increasing liabilities; this is proving to be highly attractive to individuals seeking evermore autonomy over their financial affairs.”