The Financial Ombudsman Scheme has reported a sharp rise in the number of new SIPPs cases in 2018 and is upholding an increasing number of complaints.

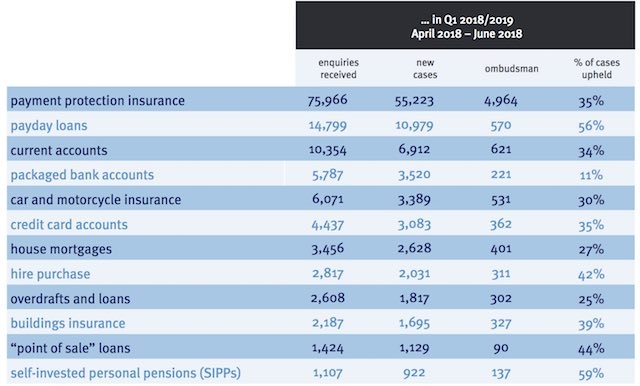

The FOS says that the number of new SIPP cases submitted in its Q1 period from April to June was up from 521 in 2017 to 922 in 2018, an increase of about 77%.

The number of complaints upheld by the Ombudsman also rose sharply in the quarter from 50% to 59%, well above the average FOS ‘complaints upheld’ rate of 35% across all products.

Data so far this year suggests the number of SIPP complaints in 2018 will far exceed 2017 when 2,051 new SIPP cases were taken on by the FOS.

Despite the increases, the number of SIPP complaints still forms only a small part of the overall FOS workload. During the quarter the FOS received a total of 107,000 complaints across all categories with more than half related to PPI. In addition, 21% of all complaints were about payday loans.

FOS data shows a rise in a number of areas, including a jump in new complaints about investment ISAs from 266 to 418 with complaints upheld in this area rising from 33% to 45%. Cash ISA complaints also rose.

New complaints about income drawdown and complaints upheld also rose although there were only 55 complaints in this area in total. Complaints about personal pensions fell slightly.

Today the FOS also urged the banks to treat victims of frauds and scams more fairly as it emerged that banks only pay out in 25% of scam cases.

See story here: FOS tells banks to avoid blaming fraud victims for scams