The Financial Services Compensation Scheme has opened an investigation into media investment firm Great Point Investment Ltd (FRN 606798) after the firm entered creditors’ voluntary liquidation on 30 July.

London-based Great Point has been authorised by the FCA since July 2014. It is an enterprise investment scheme (EIS)/seed enterprise investment scheme (SEIS) manager.

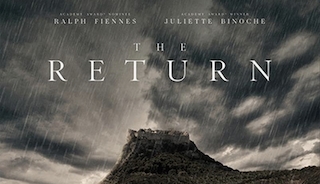

The firm also offered discretionary management services to an estate planning service and helped provide backing for a number of film and television ventures, including major movies such as The Return, which is due to be released in December.

According to the FCA, the firm provided discretionary and alternative investment fund management services through a range of investee companies operating in the global creative industries sector. It managed the Selective Television Production EIS 6 (the EIS 6 Fund).

According to the company's own website, Great Point was, "at the heart of the entertainment business" and managed investments in the areas of film and television production finance, the construction and management of studio complexes in both the US and UK and venture capital, as well as providing executive production and sales and distribution services to the sector.

On its LinkedIn page, the company described itself as being "founded in 2013 by Jim Reeve and Robert Halmi Jr. Based in Embankment, London, we are a boutique media business specialising in the development and exploitation of intellectual property in entertainment media, the distribution of media content for theatrical, television, and online platforms as well as media project finance and alternative investments (EIS, SEIS and BPR)."

It said it supported a number of productions due to be released this year including movie The Return, starring Ralph Fiennes and Juliette Binoche, and other films featuring Michael Fassbender, Rosamund Pike and Aaron Eckhart. None of these actors are connected to the collapse of the firm.

Its last post on LinkedIn was in February, announcing the sad death of founder Jim Reeve.

Great Point entered creditors’ voluntary liquidation on 30 July with Andrew Charters, Chris Laverty and Nick Nicholson of Grant Thornton LLP in Manchester appointed as joint liquidators.

The firm was placed into liquidation following the insolvency of Great Point Media Limited, the firm’s parent, and with limited funds available at the business, its director took steps to place it into liquidation.

The launching of the investigation means the FSCS is now open to customer claims against Great Point. However no claims will be resolved while the probe is undertaken.

The FSCS said: “Although we are accepting claims against Great Point, they will not be immediately passed to our claims processing teams for assessment. This is because we will be investigating the firm to see if any claims meet the qualifying conditions for compensation, and this may take some time.”

The FSCS added: “This will be a complex investigation and we anticipate working very closely with the joint liquidators.”

The FCA said the joint liquidators will be writing shortly to investors to explain what the creditors’ voluntary liquidation means and what to do if they have investments in the EIS 6 Fund.