Gaudi, the SIPP and platform fintech business, has launched a white-labelled pension income drawdown product that can be used by any financial brand.

The service is available as part of Gaudi’s white labelled SIPP or as a “plug in” for other pension providers, including those marketing to consumers or in the workplace.

Gaudi believes the income drawdown sector is set to grow strongly in the future and reliable technology is needed to speed take up and improve accuracy.

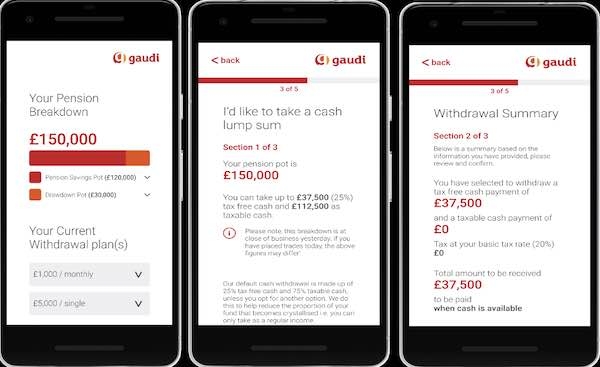

The Gaudi offering includes all pension drawdown options including taking all the tax-free cash and no income or allowing ad hoc or regular withdrawals from tax free or taxable funds.

Gaudi administers over 24,000 SIPPs and 100,000 ISAs and says offering an income drawdown service to pension clients is a natural evolution.

Planning tools are available through smart devices branded to Gaudi’s business partners.

Patrick Vaughan, managing director of Gaudi, said: “Having over 24,000 SIPPs under our administration makes it a natural progression to offer a drawdown proposition.

“We are acknowledged experts in electronically linking to a provider’s customer facing systems with the administration platform to speed every aspect of the process from application to taking regular money out. Today’s customers expect Straight Through Processing achieved through mobile devices not just for their banking but all their finances – including their pensions.”

Gaudi provides bespoke technology mainly for SIPP, Investment, and ISA technology platforms.