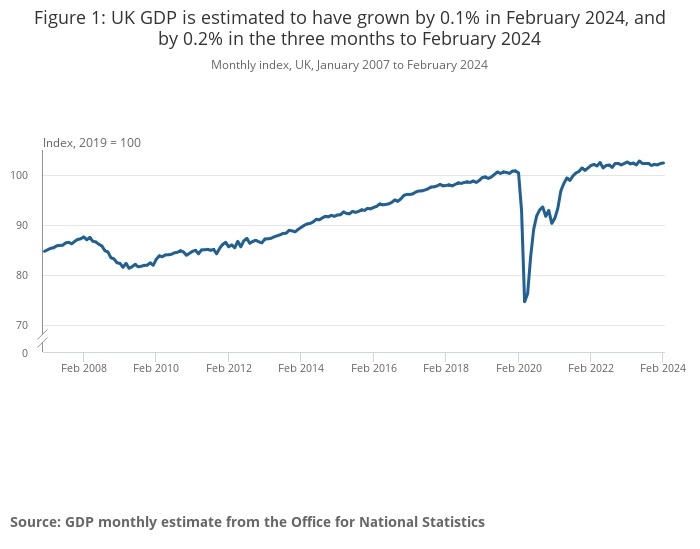

UK GDP is estimated to have risen by 0.1% in February and the figure for January has been revised up from 0.2% to 0.3% growth, raising expectations that the UK will avoid a prolonged recession.

There was strong growth in production, particularly gas and car manufacture.

Growth remains anaemic, however, according to most experts.

Services output rose by 0.1% month-on-month with construction output down 1.9% month-on-month. Production rose 1.1% month-on-month.

ONS, which produces the data, said that the construction industry was hit by wet weather.

The UK entered a shallow recession at the end of 2023 but the economy now appears to be growing, albeit at a slow rate.

Danni Hewson, head of financial analysis at AJ Bell, said the news was generally positive.

She said: “Any growth is good news and certainly the UK seems to be trudging slowly out of last year’s short-lived recession. But at 0.1% in February and even with the upwardly revised 0.3% in January, UK growth looks pretty pitiful when you compare it to the economic picture on the other side of the pond.

“The impact of rain on GDP explains why we Brits are so pre-occupied with the weather. All those downpours dampened spirits and kept shoppers tucked up in their homes. Construction work slowed once again and the rain undoubtedly played a part here, but it wasn’t the whole story.”

Nicholas Hyett, investment analyst at HNW-focused investment broker Wealth Club said: “Positive UK GDP growth in February, coming together with an upgrade to the January estimate, will do nothing to reassure markets that interest rate cuts are locked in for the first half of this year.

“Having said that, areas of the economy that are dependent on discretionary spending do look kind of soggy. Accommodation and food and drink services both contracted in February and the construction sector is in the doldrums (with eight out of nine sectors seeing a decrease month-on-month). There are suggestions wet weather may have played a part here, but an interest rate cut could be quite helpful to those areas of the economy nonetheless."

Ed Monk, associate director at Fidelity, said: “It has to count as good news that the economy is returning to growth - the GDP estimate today means the UK grew 0.4% across January and February. Last year’s recession appears to have been both shallow and short-lived but the fact remains that UK growth remains weak. We may be shaking off technical recession but that won’t change the feeling that there is very little momentum in the economy.

“If today’s reading is positive for growth overall it may end up being bad news for both borrowers and financial markets, in the short-term at least. Both are waiting for the Bank of England to cut rates but wage rises and now better performance in parts of the economy are adding to inflationary pressures. Expectations of rate cuts this year have softened and markets now expect only two cuts before 2025. It seems you can have a recovering economy, or you can have the relief of lower rates - but you can’t have both at the same time.”