Friday, 25 January 2013 16:24

UK GDP shrinks by 0.3 per cent in Q4 2012 but business a bright spot

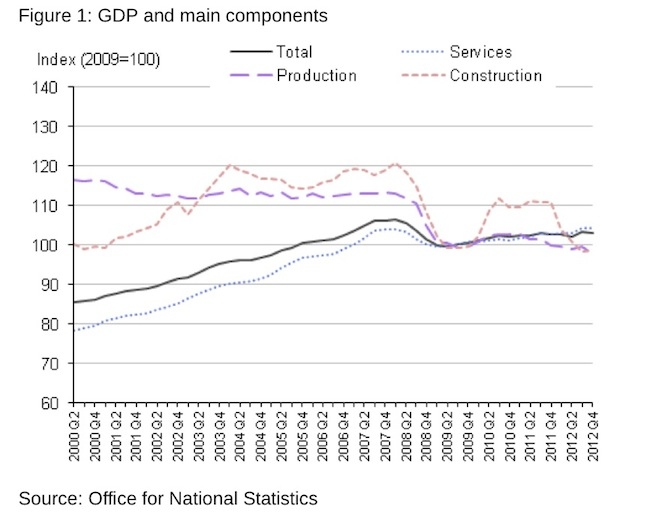

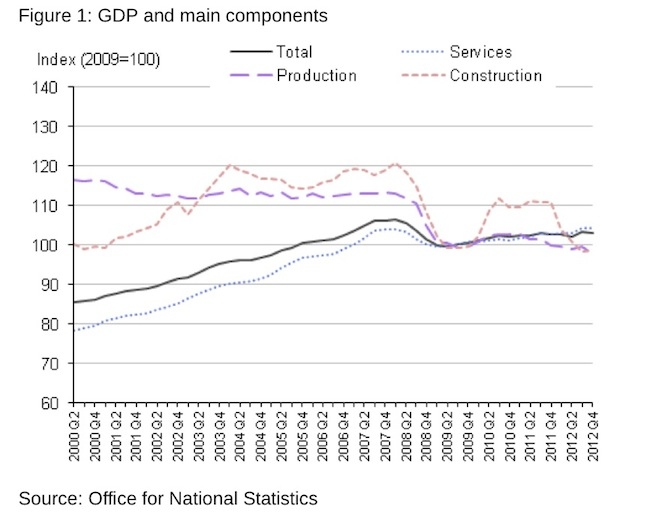

The Office for National Statistics says GDP was estimated to have decreased by 0.3% in Q4 2012 compared with Q3 2012 - although business and finance was one of the few bright-spots.

However the figures paint a picture of a flat economy and some pundits have forecast that a so-called "triple-dip" recession could be a reality this year as the economy declines once more in the face of austerity measures and little economic growth. There has also been some evidence of a "fall back" after the Olympics and Paralympics boost of last year.

ONS says that output of the service industries was estimated to have been flat in Q4 2012 compared with Q3 2012, following an increase of 1.2% between Q2 2012 and Q3 2012. The output of the production industries was estimated to have decreased by 1.8% in Q4 2012 compared with Q3 2012, following an increase of 0.7% between Q2 2012 and Q3 2012.

Construction sector output was estimated to have increased by 0.3% in Q4 2012 compared with Q3 2012, following a decrease of 2.5% between Q2 2012 and Q3 2012. GDP was estimated to have been flat in Q4 2012, when compared with Q4 2011 and is also estimated to have been flat between 2011 and 2012. All the figures will be subject to at least one and likely two revisions in the coming months.{desktop}{/desktop}{mobile}{/mobile}

While UK GDP declined overall, the index for business services and finance was estimated to have increased by 0.4% in 2012 Q4, following an increase of 0.9% in the previous quarter. Employment activities made the largest positive contribution to the increase. Employment activities also had growth in 2012 Q3 and although it was possible some of this strength was related to the Olympic Games, we had no direct feedback from survey respondents to support this. Business services and finance increased by 1.2% between 2011 Q4 and 2012 Q4. The figures suggest that the business and financial services sectors are faring better than others during the downturn.

Azad Zangana, European Economist at Schroders, commented: "The ONS' preliminary estimate of Q4 2012 GDP showed the economy had contracted by -0.3% - the fourth quarterly contraction in the last five quarters - and worse than city consensus expectations (-0.1%). Year on year growth remains at zero.

"Within the details, the construction sector made the biggest positive contribution by growing 0.3%. However, this was not enough to offset the fall in industrial production of 1.8%. Meanwhile, service sector activity was flat on the quarter.

"Part of the negative hit to growth was caused by an Olympics hangover, where the boost seen in the third quarter disappeared. This should be seen as a one-off hit to the economy. However, now that a negative GDP figure has been recorded, there is a significant risk that the UK economy suffers a triple-dip recession. Weak underlying economic activity coupled with the disruption of recent poor weather could cause GDP to fall in the first quarter of 2013.

"The external environment is not helping either. The latest leading indicators from France suggest the recession there is set to deepen, while similar data from Spain and Italy also suggest more downside risks.

"As for monetary policy, the Bank of England seems to be waiting for more evidence on the effectiveness of the Funding for Lending Scheme. The scheme has helped lower the cost of borrowing for both corporates and households, and has increased the number of higher loan-to-value products on offer. However, demand for borrowing from credit worthy individuals and firms remains low. We expect the Bank of England to restart its quantitative easing programme in the Spring as the economy continues to disappoint. Meanwhile, the sovereign rating agencies are circling. Disappointing growth and recent poor public finance numbers suggest the UK will lose its AAA rating in the near future."

Trevor Greetham, director of Asset Allocation at Fidelity Worldwide Investment, said: "A disappointing number. The UK economy is bouncing along the bottom in the weakest recovery in living memory. The more time that passes the clearer it is that America's gradual and delayed approach to fiscal tightening is the right one. As the IMF belatedly concedes, it is far easier to balance the books when an economy is growing."

However the figures paint a picture of a flat economy and some pundits have forecast that a so-called "triple-dip" recession could be a reality this year as the economy declines once more in the face of austerity measures and little economic growth. There has also been some evidence of a "fall back" after the Olympics and Paralympics boost of last year.

ONS says that output of the service industries was estimated to have been flat in Q4 2012 compared with Q3 2012, following an increase of 1.2% between Q2 2012 and Q3 2012. The output of the production industries was estimated to have decreased by 1.8% in Q4 2012 compared with Q3 2012, following an increase of 0.7% between Q2 2012 and Q3 2012.

Construction sector output was estimated to have increased by 0.3% in Q4 2012 compared with Q3 2012, following a decrease of 2.5% between Q2 2012 and Q3 2012. GDP was estimated to have been flat in Q4 2012, when compared with Q4 2011 and is also estimated to have been flat between 2011 and 2012. All the figures will be subject to at least one and likely two revisions in the coming months.{desktop}{/desktop}{mobile}{/mobile}

While UK GDP declined overall, the index for business services and finance was estimated to have increased by 0.4% in 2012 Q4, following an increase of 0.9% in the previous quarter. Employment activities made the largest positive contribution to the increase. Employment activities also had growth in 2012 Q3 and although it was possible some of this strength was related to the Olympic Games, we had no direct feedback from survey respondents to support this. Business services and finance increased by 1.2% between 2011 Q4 and 2012 Q4. The figures suggest that the business and financial services sectors are faring better than others during the downturn.

Azad Zangana, European Economist at Schroders, commented: "The ONS' preliminary estimate of Q4 2012 GDP showed the economy had contracted by -0.3% - the fourth quarterly contraction in the last five quarters - and worse than city consensus expectations (-0.1%). Year on year growth remains at zero.

"Within the details, the construction sector made the biggest positive contribution by growing 0.3%. However, this was not enough to offset the fall in industrial production of 1.8%. Meanwhile, service sector activity was flat on the quarter.

"Part of the negative hit to growth was caused by an Olympics hangover, where the boost seen in the third quarter disappeared. This should be seen as a one-off hit to the economy. However, now that a negative GDP figure has been recorded, there is a significant risk that the UK economy suffers a triple-dip recession. Weak underlying economic activity coupled with the disruption of recent poor weather could cause GDP to fall in the first quarter of 2013.

"The external environment is not helping either. The latest leading indicators from France suggest the recession there is set to deepen, while similar data from Spain and Italy also suggest more downside risks.

"As for monetary policy, the Bank of England seems to be waiting for more evidence on the effectiveness of the Funding for Lending Scheme. The scheme has helped lower the cost of borrowing for both corporates and households, and has increased the number of higher loan-to-value products on offer. However, demand for borrowing from credit worthy individuals and firms remains low. We expect the Bank of England to restart its quantitative easing programme in the Spring as the economy continues to disappoint. Meanwhile, the sovereign rating agencies are circling. Disappointing growth and recent poor public finance numbers suggest the UK will lose its AAA rating in the near future."

Trevor Greetham, director of Asset Allocation at Fidelity Worldwide Investment, said: "A disappointing number. The UK economy is bouncing along the bottom in the weakest recovery in living memory. The more time that passes the clearer it is that America's gradual and delayed approach to fiscal tightening is the right one. As the IMF belatedly concedes, it is far easier to balance the books when an economy is growing."

This page is available to subscribers. Click here to sign in or get access.