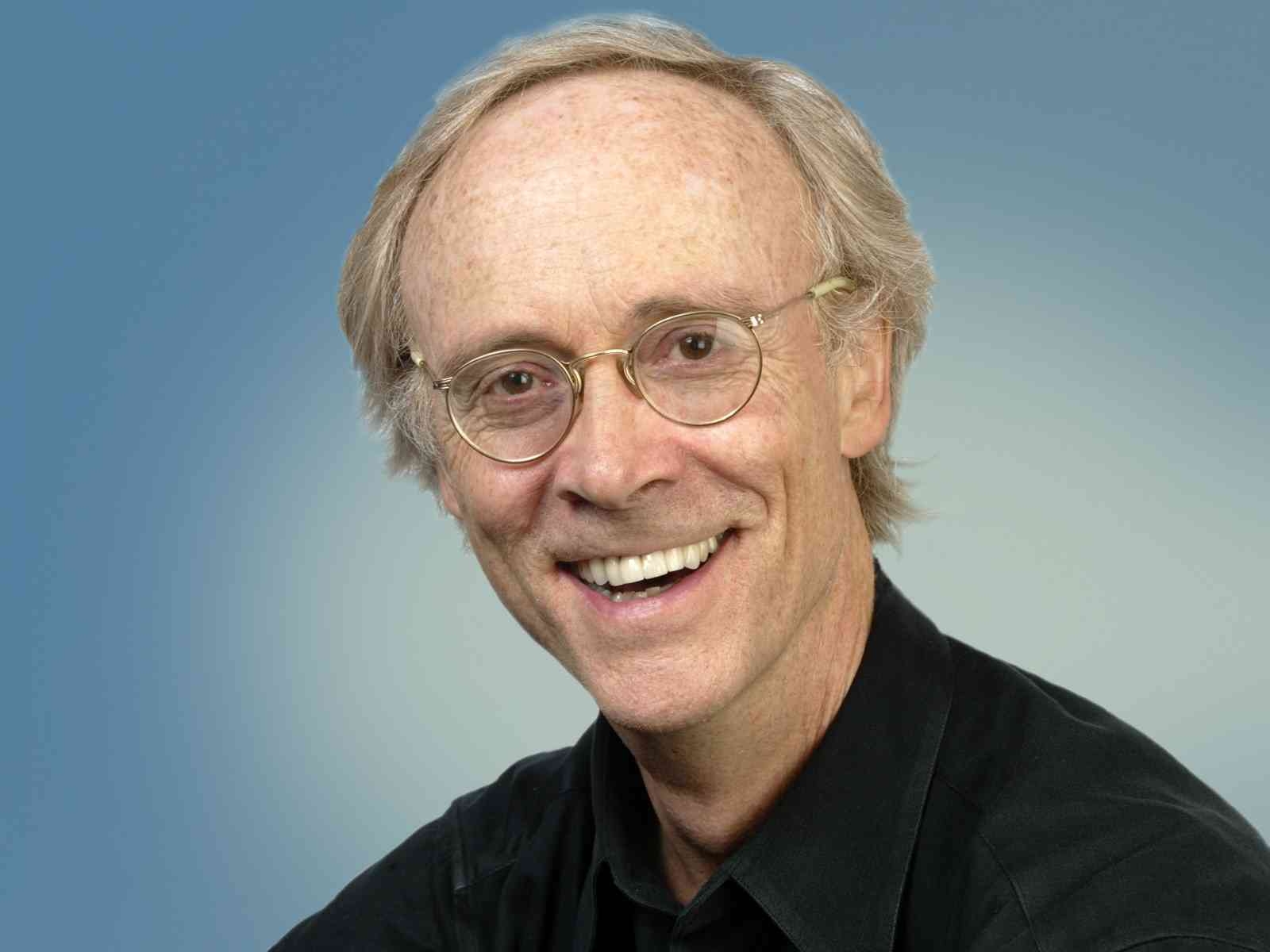

Robo-advice is a “tremendous asset” to planners who will all be utilising such tools in coming years, says Life Planning founder George Kinder.

Speaking exclusively to Financial Planner magazine, Mr Kinder described it as a friend, not a foe to Financial Planners. He said he sees great advantages in automated services.

Mr Kinder has launched his own version recently through the Life Planning For You website. It is designed to give consumers their first steps into Life Planning, while potentially leading many of them on to, eventually, a human planner.

{desktop}{/desktop}{mobile}{/mobile}

He said: “I think it’s an incredible friend and a great opportunity for financial advisers. 20 years from now everyone will be completely integrated and what happens with robo-advisers when you add a Life Planning format to it is you have the personal questions which address the deeper issues for the clients, you have the Financial Planning and the risk management and platform.

“So it is all integrated together and you can work with a much larger spectrum of the demographic and economy and all the information is digitilised and available anywhere in the world.”

He said: “I think it’s a tremendous asset to financial advisers. It saves the advisers potentially a lot of time in terms of outreach and sales. I don’t see any downside to it.”

By providing initial access information at their finger tips, such online tools can make clients more informed, he believes, helping the process.

He said: “It can mean the consumer is going to come in much better educated and an educated client is a much more stable client.”

A client might go first to a robo-adviser but then seek out a real planner as assets grow, he said. On his own website, the online advice process steers consumers towards a list of 2,000 Life Planners, should they wish to pursue it further.

Using automated services as a starting point can help break down issues of trust, when consumers feel uncomfortable going to visit an adviser, he believes.

He said: “There’s a breaking of the distrust barrier, which is a major thing a robo-adviser can do. Which is easier to trust? A stranger whose office you walk into, who is asking you personal questions?

“Or sitting at a computer terminal under your control with a secure site that doesn’t reveal your information to anyone else and just typing in what’s important to you? Particularly for a trustworthy site not trying to sell you products.”

Looking to the future, he believes there will be certain partnerships between advisors and automated advice service providers in the same way links have already developed with preferred platforms.

He said: “You will certainly see 20 years from now every adviser out there will have a digital offering as part of their offering.”

Mr Kinder still believes ultimately, however, in the power of a personal adviser. He highlighted their ability to navigate a client through complex financial details and good listening skills – which he rates as the most important attribute for a planner.