Hargreaves Lansdown, the Bristol-based investment provider, is to change to a restricted advice model and promote its telephone-based advice services by dropping minimum portfolio requirements.

The company says the changes lay the groundwork to develop a telephone-based advice proposition and allow introduction of a new, simpler tariff for advice. It says there is no change to the HL Vantage Service.

HL says that as an independent adviser there were too many obligations to research the entire market for every advice suggestion. This meant that it was forced to “research investments that clients rarely hold.” This meant it had to consider investments that were overly complicated, opaque, expensive or carried excessive investor risk – for example, complex structured investment products.

The company believes that by restricting its advisory service and focusing research and resources on the areas that “actually matter to our clients” it will will be able to improve the advisory servicesit offers, simplify fees and remove the minimum portfolio size for advice.

For a minimum fee of £495 it will now advise clients over the telephone regardless of the size of their portfolio. The fee for face to face advice will be £1,495. VAT applies and the changes becomes effective from today (1 October 2015).

{desktop}{/desktop}{mobile}{/mobile}

Danny Cox, head of communications, Hargreaves Lansdown, said: “In reality investors will see very little change in what we advise over. We shall continue to offer the same broad range of investment advice, including portfolio management, investment and pension advice, retirement planning and inheritance tax mitigation as we do now.”

Through the Vantage and portfolio management services it offers more than 2,500 funds from over 200 different fund management groups and these will continue to be considered. Where there are more specific requirements it will continue to use other third party providers and products.

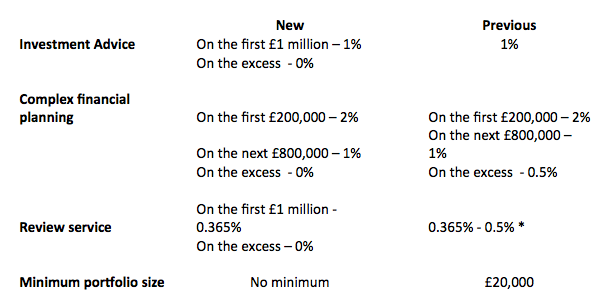

HL’s advisory fee tariff has been simplified and capped as shown below:

In addition, HL’s sister company Hargreaves Lansdown Asset Management is also simplifying the charges for its Portfolio Management Service (PMS). From 1 December 2015 the changes will be:

· HL is removing the annual 0.75% +VAT Discretionary Charge that applies where third-party funds are used in PMS. The proportion of third-party funds used in PMS varies between portfolios, so this charge currently represents between 0.05% and 0.07% of the overall portfolio value per year, depending on the portfolio.

· HL is also adjusting the annual PMS fund charge in each account as follows:

- On the first £250,000 the charge will change from 0.45% to 0.51% per annum.

- For assets between £250,000 and £1 million, the charge will change from 0.25% to 0.30% per annum.

- HL will remove the 0.10% currently charged for assets between £1 million and £2 million.

The net result of removing the Discretionary Charge and adjusting the Annual Portfolio Management Service Fund charge means that the majority of clients will pay no more than now, and some will pay less.

A minority of clients will pay up to 0.007% more for this service.

Currently, PMS clients pay an ongoing advice fee of 0.365% + VAT per annum for access to an annual advisory review service. From 1 December 2015 this charge will be capped such that the ongoing advice fee will apply on PMS portfolio values up to £1 million, with no further charge on PMS assets above £1 million. This means clients with PMS portfolios of less than £1 million will pay the same as they did before. Clients with PMS portfolios over £1 million will pay less.