Higher inflation data for non-retired households released today by the Office for National Statistics could put pressure on the pensions Triple Lock pledge, according to consultancy Broadstone.

Non-retired households continued to experience a higher annual rate of inflation (4.8%) than retired households (3.4%) for the year to March 2024, according to the new data.

Household costs also rose more for households with children (4.8%) than for those without children (4.8%), primarily driven by higher contributions from mortgage interest payments.

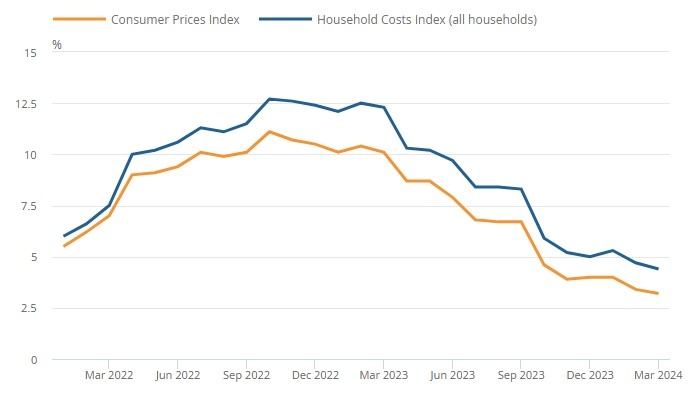

Overall, UK household costs, as measured by the Household Costs Index (HCI), rose 4.4% in the year to March 2024, slowing from the annual rate of 5.3% in January 2024.

Unlike CPI inflation rates, the HCI takes into account changes in mortgage interest rates, stamp duty and other costs related to the purchase of a home.

In the most recent month the all-households HCI annual rate was 4.4%, compared with a CPI annual inflation rate of 3.2%.

In the year to March 2024, mortgage interest payments increased by 36.1% while electricity, gas and other fuel prices fell by 18.3% which was said to be driving the disparity.

Simon Kew, head of market engagement at consultancy Broadstone, said these latest figures could cause voters at the General Election to call into question the Triple Lock pledge.

He said: “The cost of living continues to rise faster among non-retired households as the increase in mortgage rates continues to impact inflation while falling energy bills provides succour to pensioners.

“The data comes amid the Conservatives ‘Triple Lock Plus’ pledge to protect pensioners from increases in the State Pension exceeding their Personal Allowance. If inflation for non-retired households remains stubbornly high and above that of retired households, it will only serve to raise questions around how fair and well-targeted this ‘Triple Lock Plus’ policy is.

“However, lengthening mortgage terms taking borrowers into retirement may minimise the impact of this trend moving forward as mortgage and rental costs become an increasingly prominent issue for pensioners, especially for the millions of those who are largely reliant on the State Pension for their income.”