Research by HMRC has found that there is low engagement between consumers and their taxes with just 10 per cent knowing the exact amount of tax they paid.

The research, conducted in February by TNS BMRB of over 2,000 people, found just 26 per cent of people checked their tax statements.

This compares to 70 per cent who regularly check their bank statements.

However, the task was linked to tax experience with the figure rising to 37 per cent for those who submitted a self-assessment form.

Despite this low engagement, 66 per cent said it was very or quite important that they could see how much tax they were paying on their payslip and 55 per cent were interested in a personal tax statement. Some 65 per cent said it was easy to find out how much tax they paid.

This number dropped for those in the lowest category, aged 16-24 years old, only 46 per cent of this age-group said they found it easy to check their taxes.

While respondents stated they found it easy to find out, this did not mean they knew how much they paid with 57 per cent of respondents stating they did not know how much they paid in a year. Men were more likely to know than women and the most engaged group was men aged 45-64.

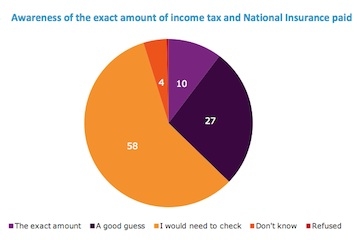

When it came to giving specific amounts, the majority of respondents said ‘they would need to check’ with only 10 per cent being able to give the exact amount.