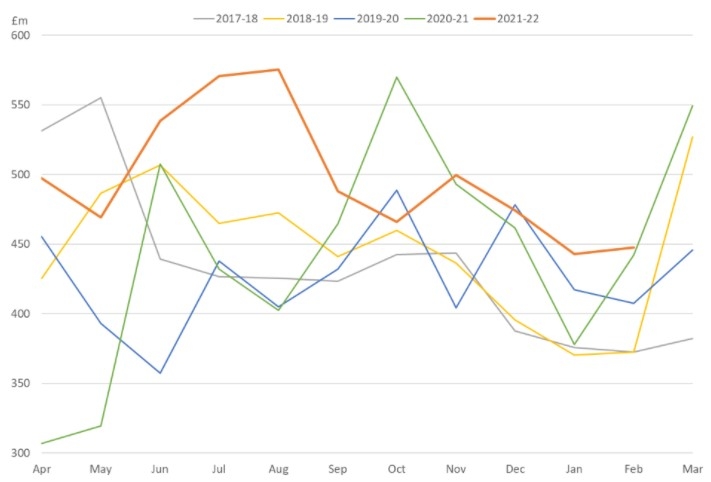

Inheritance tax receipts for April 2021 to February 2022 hit a new record high of £5.5bn.

The previous high was £5.36bn for the 2018/19 tax year.

The receipts for April 2020 to February 2022 were £0.7bn higher than the same period a year earlier.

HMRC said higher receipts are expected to be due to higher volumes of wealth transfers that took place during the Coronavirus pandemic, but it does not yet have the full administrative data.

Shaun Moore, Financial Planning expert at Quilter, said eyewatering house prices are leading to more people being caught by the IHT net.

He said: "These ever-increasing figures demonstrate that the government are gradually increasing tax revenues without significantly increasing the burden on taxpayers. However, IHT was once viewed as a tax on wealthier individuals, but due to runaway house prices more people are getting caught by the tax and many people who would not consider themselves wealthy will now face a hefty IHT bill. This is well reflected in the fact that London and the Southeast have the most amount of estates paying IHT, which is due to the above average house prices in the region."

Helen Morrissey, senior pensions and retirement analyst at Hargreaves Lansdown, said: “It’s been a bumper year for HMRC with inheritance tax and stamp duty surging to all-time highs this month while the growing number of people returning to the workforce means income tax and national insurance receipts continue to grow.

“It is hugely positive to see people going back to work, but this data shows the heavy toll the pandemic has laid on society with inheritance tax receipts hitting all-time highs – they could hit as much as £6bn by the end of the tax year. This is largely because of an increased number of wealth transfers throughout the year. While we hope the number of transfers will drop as the pandemic claims fewer lives, we will still see more estates become liable over the coming years as the freezing of inheritance tax thresholds continues to bite.”

This is a developing story so please back later for more commentary.