The number of firms with no Paraplanners grew in the last year, according to an exclusive Financial Planning Today survey.

The full results of our annual Financial Planning Survey are available now in the latest issue of Financial Planning Today magazine, which can be read for free here.

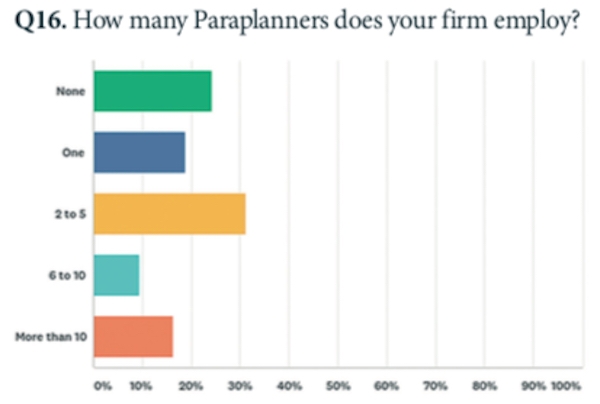

Regarding Paraplanning then survey revealed that, although 43% of respondents said they believed Paraplanners would become “more important” to their business the number of firms with no Paraplanner actually grew.

This year close to a quarter of companies (24%) had none, compared to less than 13% last year.

There was further bad news for Paraplanners as it was revealed this year’s results showed 75% of firms employed at least one Paraplanner versus 87% last year.

Soaring salaries for Paraplanners, lack of supply of qualified staff and the rapid growth of outsourced Paraplanning could be reasons why some planning firms are doing without in-house Paraplanners and finding alternatives such as outsourcing.

The decline in employed Paraplanner numbers did not reflect what Financial Planning professionals said about Paraplanners, which was broadly positive.

Julie Lord, chief executive of Magenta Financial Planning, said she expected numbers to increase long term and added: “Paraplanners are the technical and research backbone of any great Financial Planning business.

“They will all be qualified to a much a higher level than Financial Planners who in time will just be needed for their relationship skills.”

Chloe Moran, a senior Paraplanner and Chartered Financial Planner at 1825 said: “Paraplanning is becoming a more well- known profession.

“It still remains for a lot of people a stepping stone into an advice role and proves a great foundation through all the technical knowledge you learn as a Paraplanner.

“However, it is certainly becoming a great career for those people who are very technical, who may not want to be in a client facing role.

“I think the demand for highly qualified Paraplanners will continue to increase and those who are very technical will do well.”

James Gordon of Northern Ireland-based firm AKFP added: “I think people will see it as a career path rather than an ‘inroad’ to Financial Planning.

“I think numbers will increase due to the way it is viewed as a career path.

“I believe the role will become a technical support for the adviser where nearly everything apart from meeting with the client will become part of the job spec.”

Recently more than 100 Paraplanners gathered in Stratford-upon-Avon for the CISI’s annual Paraplanner Conference.

To read the full survey results click here