The role of Paraplanners is set to take on greater importance in the next three years, according to a recent survey.

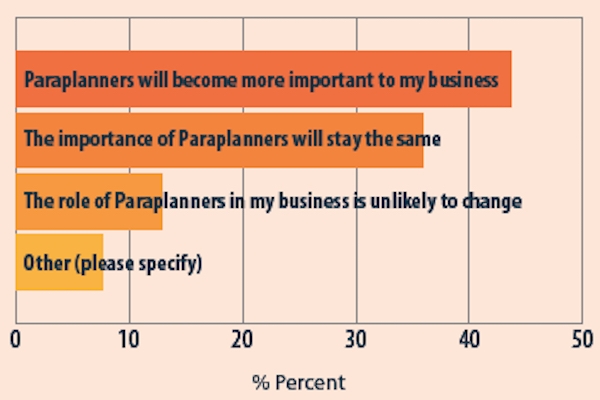

More than 40% of respondents to Financial Planning Today’s recent State of the Financial Planning Profession survey, which features on the latest edition of Financial Planning Today magazine, said the role of Paraplanners would grow in importance to their business in the coming years.

The figure rose from last year’s survey result, from less than 40% to 43.6% this year.

Close to 36% said their importance would remain the same.

The survey also revealed that the vast majority of firms (87.2%) had at least one Paraplanner, with 46.1% employing between two and five.

Just over 10% had six to 10 Paraplanners and more than 5% employed more than 10.

Last year 18% of firms employed no Paraplanner at all with that figure dropping to just under 13% this year.

Dan Atkinson FPFS MCSI APP Chartered Financial Planner, head of technical at EQ Investors in London, welcomed the results of the survey.

He said: “These are encouraging stats.

“I’m not surprised to see so many firms sharing that Paraplanners are an important and growing part of their business.

“It lets planners focus on client relationships and provides them with a valuable sounding board.

“It’s great to see so many respondents looking to increase their number of Paraplanners.

“Given the key role that Paraplanners play in many businesses, whether they are employed directly or work on an outsourced basis, this shows that the future remains bright for Paraplanning.

“It’s a vibrant and attractive career path and the next big step is to encourage new entrants to make this their first career in Financial Planning.”

Mr Atkinson’s sentiments were echoed by Chloe Moran, senior Paraplanner at 1825, who said: “It’s great to see such positivity about Paraplanning in the numbers.

“Paraplanning has definitely evolved as a career and it’s clear the industry is stable and growing.”

She added: “Paraplanning is crucial for the future sustainability of Financial Planning, it’s a good route for individuals to take before becoming a Financial Planner, if they wish to pursue that route, and a way to ensure fresh, young blood is entering the industry.”

Ms Moran did sound a note of caution and said technological advances like report writing software could hit Paraplanning, but she said it would be “a challenge to replace the knowledge and skill of a Paraplanner in terms of problem solving, questioning and long term cashflow planning.”

She said she also expects Paraplanning to become “more of a recognised career path for school leavers and graduates” in the near future.

The success of the CISI Paraplanner Conference in June highlighted the strength of the sector, with 120 attendees turning out for the two-day event in Hinckley, Leicestershire.

At the event Aleksandra Sasin, chief Paraplanner at Navigatus, delivered a personal perspective on the sector entitled ‘How Paraplanning has changed my life and lets me do what I love - helping clients get the right outcomes.’

She highlighted the varied role of a Paraplanner and how they can make a difference to the lives of clients.

Financial Planning Today has also reported on firms boosting Paraplanning recently.

The full survey results appear in the latest issue of Financial Planning Today magazine.