One of the ways in which the Government is taking action to deal with the fiscal deficit is to pile pressure on higher rate tax payers to pay a greater share of income tax. Not only that, says tax expert John Woolley, but in the tax year 2011/12 it is estimated that because of the fiscal effects of an increase in the personal allowance and a disproportionate reduction in the basic rate tax band (which was designed to stop higher rate taxpayers benefitting) there will be about 750,000 more higher rate taxpayers.

Fortunately there are still a number of ways in which higher rate taxpayers who are affected by these changes can take action to reduce their tax bill. This article looks at what is on offer.

There are a growing number of ways in which the Government is turning the screw on higher rate taxpayers.

The following categories of people can be identified as those who have been particularly disadvantaged by the income tax changes that have taken place or are due to take place:

Those with income of more than £100,000 who lose all or part of their basic personal allowance and so suffer an effective tax rate of up to 60 per cent.

Those with taxable income of more than £150,000 who now suffer 50 per cent income tax on the excess (42.5 per cent on dividend income) and

Those who will pay higher rate tax for the first time because of the changes to the personal allowances and higher rate tax threshold in 2011/12.

In addition, following the Chancellor’s interview with the BBC in October 2010, it seems very likely that higher rate taxpayers will not be entitled to Child Benefit with effect from January 2013. And, of course, in the meantime many higher rate taxpayers will have been hit by the 1 per cent increase in national insurance contributions (NICs) on earnings above £42,475 per annum.

Fortunately tax planning possibilities are available to most people regardless of their tax position and we will now look at ways in which these people can improve their position, depending on which category they fall in. Since 6 April 2010, the basic personal allowance has been subject to an income limit of £100,000. Where an individual’s “adjusted net income” is below or equal to the £100,000 limit, they will continue to be entitled to the full amount of the basic personal allowance of £7,475 in 2011/12.

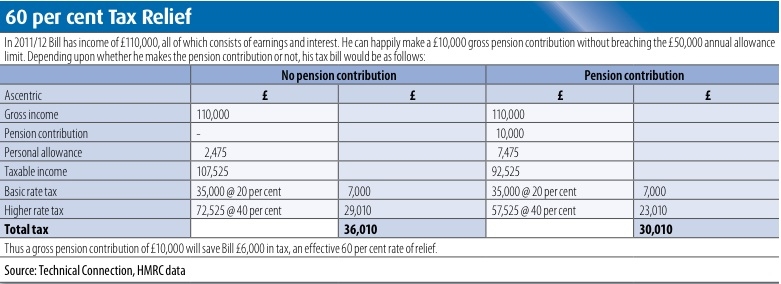

But where an individual’s adjusted net income is above the limit of £100,000, the amount of the allowance is reduced by £1 for every £2 above the income limit. For example, based on the personal allowance of £7,475 for 2011/12, then an adjusted net income of £114,950 or above would mean that no personal allowance is available. This means that any income that causes a loss of the personal allowance could be taxed at an effective rate of 60 per cent. It should be noted that although pension contributions paid net of basic rate tax at source are not deductible from total income to arrive at net income, they are deductible for the purpose of arriving at “adjusted net income”.

A number of people may have adjusted net income of just over £100,000 which causes them to lose a part or all of their personal allowance. The type of planning that they should implement to restore their personal allowance depends largely on the type of income that causes the cut back.

Earned income

Where it is earned income that takes the individual into the £100,000-£114,950 bracket they should seek to reduce this by either paying a pension contribution or arranging for a salary sacrifice. With the marginal rate of tax in the £100,000 - £114,950 band of earned income being 60 per cent it may be possible to obtain 60 per cent tax relief on some pension contributions as the example below illustrates.

Investment income

Where it is investment income that causes the individual’s adjusted net income to fall into the £100,000- £114,950 band then, depending on a person’s circumstances, any of the following may be appropriate strategies:-

Redistribution of investment capital to a spouse with a lower income so that the income generated is taxed on him/her instead reinvestment in tax free investments, such as an ISA, so that taxable income is replaced with tax free income

Reinvestment in tax-efficient investments that generate little or no income and so will not impact on the loss of the personal allowance. Such investments would include unit trusts/OEICs geared to producing capital growth and single premium investment bonds from which a 5 per cent tax- deferred withdrawal may be taken each year, for 20 years, without affecting the personal allowance calculation. It is important to note that neither an EIS nor a VCT investment will help to reinstate the personal allowance by reducing an individual’s income.

There are various strategies that a higher rate taxpayer should consider as a way of reducing the impact of tax. These include:

Independent taxation

For people who are married or have a registered civil partner, tax saving opportunities are still available by diverting income into the lower-income partner’s name.

Transfers between couples

In cases where one spouse pays a lower rate of tax (or no tax) than the other spouse it can be tax beneficial, subject to practical considerations, to transfer investments to that spouse to save and increase overall net of tax returns.

A non-working spouse with no investment income can receive income of £7,475 for tax year 2011/12 before he or she pays any tax. The next £35,000 of taxable income will, in general, be taxed at the basic rate.

Transfers between married couples, where both spouses are UK domiciled, will not incur any inheritance tax nor will there be any capital gains tax (CGT) if they are living together. In order to benefit from the tax advantages, the transfer must be genuine with no agreement that the transferor will benefit in the future ie. the transfer must be outright and unconditional.

Where the assets transferred generate interest or interest distributions, the maximum tax saving is 50 per cent. Where the assets to be transferred generate dividend income, the maximum tax saving will be 32.5 per cent (that is, 42.5 per cent less 10 per cent). These maximum savings will arise in cases where the person transferring is a 50 per cent additional rate taxpayer and he/ she is transferring investments to a non-taxpayer.

Self-employed people and owner/managers of small companies may be able to manipulate income levels by adjusting salary/bonuses to reduce tax.

For the owner of a small company this will be easier to achieve by adjusting salary/bonuses and dividend levels and retaining more profits within the business. Remember that any transfer of shares to a spouse to enable the spouse to receive dividend income and be taxed at a lower rate should only be of fully paid ordinary voting shares in the company which have full capital and voting rights.

For the self-employed this will be more difficult and will involve consideration as to whether they can genuinely consider employing a spouse and so indirectly transfer income.

Transfers of assets may also enable the transferee spouse to utilise their CGT annual exemption of £10,600 in the future or pay a lower (18 per cent) rate of CGT on realised gains if those gains do not make the recipient a higher rate taxpayer.

Planning with tax-efficient investments

With the rates of tax effectively having increased, it is most important that people invest in the most tax efficient way possible. All of these should be looked at; Isas, Growth oriented unit truts and Oeics where CGT allowances can be used, single premium investment bonds, maximum investment plans, enterprise investment schemes and venture capital trusts.

Isas

The Isa is still the main method of investing savings with freedom from income tax and capital gains tax without giving up the flexibility of access to the investments.

The overall annual contribution limit to an Isa is £10,680 of which no more than £5,340 can go into a cash Isa. The balance can be invested in a stocks and shares Isa. This means a couple could between them invest £21,360 in tax year 2011/12.

We await final details on the Junior Isa but the investment limit on this is expected to be announced at £3,000 in November 2011. Of course, no tax relief applies on an investment to an Isa but income and capital gains are free of tax.

The tax credit on a dividend is not recoverable and so, for the basic rate taxpayer, an Isa invested in equities gives no income tax advantage. However, for a 40 per cent taxpayer, tax freedom means the net dividend income yield improves by 33.3 per cent and for a 50 per cent taxpayer by 56.5 per cent. Other tax-efficient investments Based on the current rules the following investments look tax attractive for the higher/additional rate taxpayer:

(a) Growth-oriented unit trusts/ Oeics:

Given the relatively high rates of income tax as compared to the current rates of capital gains tax (CGT), it can make tax sense to invest for capital growth as opposed to income. Although income (dividends and interest) on collectives is taxable – even if accumulated - if this can be limited so can any tax charge on the investment.

Instead, if emphasis is put on investing for capital growth, not only will there be no tax on gains accrued or realised by the fund managers, it should also be possible to make use of the investor’s annual CGT exemption (currently £10,600) on later encashment. An effective way to use the annual CGT exemption on a regular basis but retain indirect control over the investment would be use Bed-and- Isa, Bed-and-Sipp and Bed-and- spouse strategies.

(b) Single premium investment bonds:

Single premium investment bonds can deliver valuable tax deferment for a higher/additional rate taxpayer. Because single premium investment bonds are non-income producing, no taxable income arises for the investor during the “accumulation period”.

(c) Maximum investment plan (MIP):

The MIP has become even more attractive for high earners willing to make long-term regular savings. Within a UK life company, MIP funds are subject to a maximum of 20 per cent tax on income and post-inflation capital gains. The main tax attraction of these plans is that the proceeds at maturity (usually after 10 years) are generally completely tax free, irrespective of amount. However, the funds are not easily accessible before the expiry of 10 years.

(d) Enterprise Investment Scheme (EIS):

The EIS offers tax relief on an investment in new shares of an unquoted trading company which satisfies certain conditions. For tax year 2011/12 an investment of up to £500,000 can be made to secure income tax relief at up to 30 per cent, with relief being restricted to the amount of income tax otherwise payable. (e) Venture Capital Trust (VCT):

The VCT offers income tax relief for tax year 2011/12 at up to 30 per cent for an investment of up to £200,000 in new shares, with relief being restricted to the amount of tax otherwise payable.

Pensions offer particular opportunities. The last year has seen significant changes in the pension tax rules. Many of these create opportunities for higher rate tax payers to make tax efficient pension provision.

It is still possible to get higher rate tax relief on pension contributions – this will be at 40 per cent for the higher rate taxpayer and 50 per cent for those who pay tax at the additional rate. However for these people they should take action sooner rather than later as this Government has announced that it regards the 50 per cent tax rate as temporary.

Higher rate tax payers should maximise use of their entitlement to carry forward of unused annual allowance. Furthermore, unused annual allowance from tax year 2008/09 must be used in 2011/12 or it will be lost.

In the run up to retirement, people must be more careful about how they deal with their pension plans because there can be dramatically different tax outcomes depending on the circumstances. For example, if somebody has substantial other assets, it may be best to draw on those assets to meet financial needs in retirement before age 75 and leave the pension plan in an un-crystallised form.

Finally we cannot conclude without a brief comment on inheritance tax. Individuals who pay higher rate tax may also have sizeable estate and so should keep an eye on inheritance tax. Now is a good time to plan because the rules have settled down with the inheritance tax nil rate band has been frozen at £325,000 until 5 April 2015. This means people can assess the potential liability with a bit more certainty and plan ahead. Many of the investments and strategies I have mentioned above can be established in an IHT efficient way - quite often by using a suitable trust.