In the current economic climate it is a brave man who will commit his thoughts on the prospects for UK wealth and the wealth management sector. However despite the turmoil in the markets, we at MDRC have published our 13th annual review of the HNW sector and, if we take a step back from the current uncertainties, we are broadly optimistic for the prospects for UK HNW and the wealth management sector. We also see potential for Financial Planners offering holistic advice to do well.

We estimate that the number of high net worth individuals in the UK increased by 4.5 per cent to 541,500 in 2010. Within these totals, we estimate that around 68,000 were new to the pool and 44,500 previously HNW fell below the HNW threshold. However, it is worth noting that of the 68,000 new high net worth individuals, the overwhelming majority of this new wealth came from the increase in the value of their existing investments – sadly there is very little real new wealth creation in the UK at the moment.

It is probably worth reflecting that over the past 15 years or so more than half the new wealth in the UK came either from individuals active in financial services, particularly sophisticated financial services (“The City”) or from individuals involved in property development. It is likely to be some time before either of those two sectors are major drivers of personal wealth in the UK.

This has become a key strategic consideration for the wealth management sector in that most of the target segment are already wealthy and have been for some time. So instead of being able to rely on the growth in the number of high net worth individuals as a source of new business opportunities, the UK’s wealth managers are all “fishing in the same pool” for new clients and these potential clients probably already have some relationship with a financial adviser.

As the size and shape of the HNW sector has been static, so the broad characteristics and make up of the HNW has not changed significantly over the past 12 months; around 32 per cent of high net worths were non-working, while business owners now make up 22 per cent of the high net worth population. Wealthy women made up 50.2 per cent of the HNW population and just over 50 per cent of women and just under 50 per cent of men place themselves in the ‘balanced’ risk category.

So given that the high net worth sector is not growing rapidly why are we optimistic about the prospects for wealth management? Primarily because the UK’s wealth management sector has been catalysed into changing its traditional wealth management business model by the difficult business environment and forthcoming regulatory changes. One positive outcome from the past three difficult years is the emergence of a deeper understanding of the new business environment in the wealth management sector.

Most firms have found that recruiting and retaining clients has become a significant challenge and the old business models were increasingly less likely to succeed against those firms that were becoming more proactive in responding to changes in client expectations. Although not yet entirely client centric, wealth managers are embracing the changes demanded by clients (and regulators) and developing new products, services and delivery mechanisms to meet client needs. Prior to 2008 we observed that the majority of wealth management businesses were pursuing business models developed a decade earlier, but in 2011 we saw that the vast majority of the UK’s wealth managers have changed their models to pursue strategies that fit the new competitive climate.

In preparing for the current review of the UK sector we sought input from nearly 4,000 HNW individuals, 600 of whom would be classified as UHNW (Ultra High Net Worth) but, despite the positive outlook, wealth managers and advisers might be dismayed to hear that 60 per cent of high net worth clients would expect to pay an adviser less than their accountant, and do not believe investment management is good value for money. This study also found that nearly 90 per cent of respondents would expect to pay their financial adviser less than their lawyer.

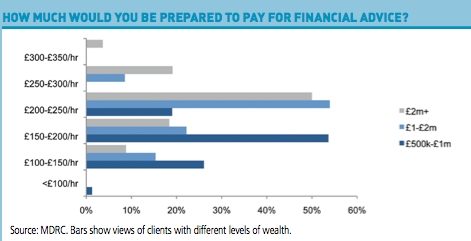

Most high net worth individuals with lower value portfolios would be prepared to pay £150 to £200 per hour for financial advice, while those with larger portfolios would be willing to pay £200 to £250 per hour, reflecting the recognition of the legal complexities associated with wealthier clients. Value for money continues to be important in the current climate and the majority of high net worth clients consider a more holistic offering better value for money than pure investment management. This will be wecome for firms that have sought to diversify their business models during the run-up to the RDR by acquiring or building Financial Planning divisions.

One surprising finding from our research was that a high proportion of self-directed high net worth individuals who normally would not consider paying for financial advice believe that wealth management is better value than pure investment management, with anecdotal evidence suggesting that pension-related advice was of surprising importance.

Looking ahead, we anticipate three to four years of modest growth in the UK high net worth sector, marked by the evolution of an increasingly confident and financially aware wealthy client who is wary of opaque products and is becoming less risk averse than in recent years. Although affluent and HNW growth will be above the growth in the UK economy as whole, the sector will not return to the pre-2008 rates of growth during this period. However, our research suggests that some fundamental characteristics of the HNW are unlikely to change, these individuals are time constrained and keen to protect their lifestyles. We see a continuation of the recent shift in the financial priorities of the “average” HNW individual – prepared to consume assets to ensure a comfortable lifestyle (particularly in retirement) and less concerned about passing wealth to succeeding generations.

We also see a continuing interest in the concept of wealth management particularly from wealthy women, but the products and services on offer from private banks and private client wealth managers still fail to attract most of the target market. Inevitably, there will be winners and losers in wealth management. Our research points to a modest increase in the “traditional” style of wealthy individual, content to have his or her assets managed at arms length but the majority of the HNW still wish to have some degree of involvement in the management of their wealth, even if this has been reduced to an occasional phone call with their wealth manager. This is a legacy of the market turmoil in 2008/9 and although wealth managers have performed well recently, many HNW have lingering concerns about another “bubble.”

One potential change comes from the impact of the proposals in the FSA’s Retail Distribution Review. It seems likely that these proposals will strengthen the position of integrated wealth management in the UK as the independent advisory sector undergoes a degree of metamorphosis.