Fraser Donaldson of Defaqto investigates the technology behind the platforms and how planners can use them best.

In a historic moment for platforms, the beginning of 2010 saw assets under administration on platforms push through the £100bn mark for the first time, marking the moment when platforms ceased to be just one option to consider when management investments. At this time, platforms became mainstream.

The Retail Distribution Review (RDR) has meant that all Financial Planners are examining their business models and positioning themselves for the post-2012 world and how they use technology such as platforms will be high up on the agenda for most advisers.

The fact that most RDR policy has now been laid down has focussed the minds of many, some of whom will no doubt have believed that RDR was either not going to happen, or would be watered down in its delivery. This is clearly not the case. This has led to an accelerated interest in platform technology and an examination of their choices by those who have already adopted it.

Assets under administration on platforms at the beginning of 2011 stood at just over £150bn. While this is a jump of 50 per cent in just a year, and we have seen continued growth throughout 2011, we expect this to continue right up to the end of 2012 and beyond – a golden period if you like with the RDR acting as the catalyst. The next 18 months will be taken up with Financial Planners looking at their current platform selection and checking they meet the needs of their clients. Those who are still considering adopting a platform for their business will be undertaking due diligence to see which models best suit the profile of their clients.

Although there are still some uncertainties surrounding RDR platform policy, with the issue of fund manager rebates still unresolved, the FSA has nonetheless clarified its position considerably over the last year with regards to the use of platforms within a Financial Planner’s business.

Platforms and independence

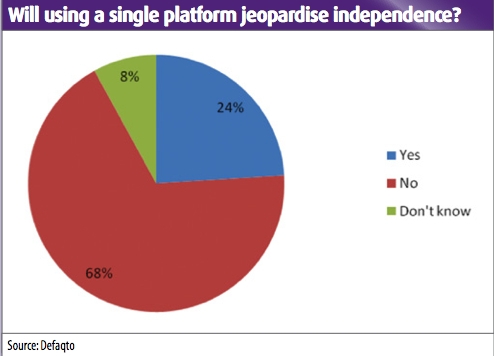

For those Financial Planners that have already adopted a platform, or are in the process of doing so, one of the greatest area of uncertainty has been the question of whether using a single platform will jeopardise the independence of the advisory firm. In April we published the findings of our annual platforms survey, which asked 232 advisers about the extent and nature of their platform- related activity, and their level of satisfaction with the platforms they deal with. The survey identified that some 68 per cent believed that using a single platform would not jeopardise their independence. This figure had changed little on the previous year despite clarification on the issue in the FSA’s November 2010 Consultation Paper. The majority are right but there are some important provisos. There is a process here that, if followed, should ensure that Financial Planning firms do not fall foul of the regulators.

The regulator’s belief that no single platform will be able to serve the needs of all investment clients should be the guiding principle. Further, the regulator would be highly suspicious of any firm that claims otherwise, and these are likely to come under close scrutiny. The needs of the client must take precedence over the needs of the Financial Planning business.

The key to the conundrum is client segmentation. There will be clients that are not suitable for platforms at all, perhaps requiring certain features on a tax wrapper that are not available ‘on platform’.

There will be those clients that are occasional or one off traders that may be suitable for a low-cost no frills trading platform, simply requiring an outlet where an odd fund or Isa can be purchased cheaper than elsewhere. Finally there will be those clients who will benefit from a service that offers additional facilities and benefits. Already this sounds like a minimum of two platforms! So, a Financial Planner’s choices are as follows:

Use a single platform only, as long as clients identified as not suitable for platforms are dealt with as such. Secondly, clients that are suitable for a platform, but not for the one the Financial Planning firm is currently using, must be referred on.

Alternatively, a firm could use two or more platforms, so that all clients that are suitable for a platform are catered for within the same business. The same proviso applies here in that those clients identified as not suitable for platforms should be catered for ‘off platform’. If nothing else, it should be good business practice for Financial Planners to adopt more than one platform. If anything should happen to one of the platforms, and not all have survived the last decade, there will already be a replacement, for some clients, already integrated into the business. Indeed, our survey indicates that on average, just over two platforms are used in each adviser business.

The benefits of platform technology It is fair to say that the messages that platform operators have been sending out over the last decade have got through. Plenty has been written about the benefits of a platform over the last decade, and really little has changed. A summary of the benefits can be seen in the table (right). In almost all these areas, the adviser and client interests are aligned. Where there is benefit to the adviser, there is also a benefit to the client.

Right for the client, right for the business Areas of key importance to planner businesses will vary from one firm to another but according to our survey there are perhaps six main areas that advisers should focus on when undertaking due diligence:

To help advisers with platform selection, our IFA research tool – Engage – provides an independent Star Rating of each platform provider. Each provider is given a rating of 1 to 5 based on the results of our survey in terms of the level of service satisfaction advisers believe they provide. Engage also includes platform financial strength ratings. Launched in December 2010, these ratings (provided by actuarial firm AKG) indicate a platform operator’s ability to survive for the long-term.

Much of the due diligence can be achieved through quantitative comparisons, but we would recommend that this is supplemented with face to face meetings. Adopting a platform is a bit like entering in to a business partnership. The selected platform has to be right for clients, but as planners could be dealing with them every day for several years there must be a sense that the platform chosen will be easy to work with. Subjective issues should not be underestimated.