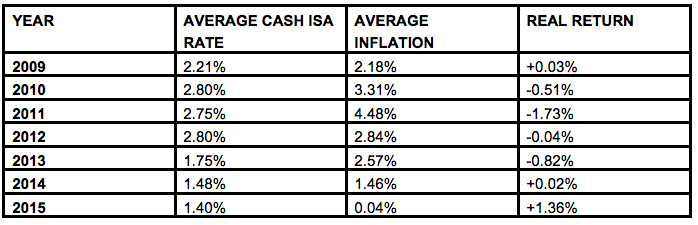

Cash Isas have provided dismal returns in four of the past seven years after inflation is taken into account, according to a survey.

The average annual return since 2009 is just 1% for cash ISA savers, according to the study by MetLife. Cash ISA savers are marking an unhappy anniversary this month as seven years of 0.5% base rates condemn them to average annual returns of just 1%, says MetLife.

The analysis of average annual cash ISA rates shows an average cash ISA saver has received just 6.8% in interest since March 5th 2009 when the Bank of England Monetary Policy Committee cut rates to 0.5%.

There is little consolation from current low inflation - in four of the past seven years cash ISA savers have even lost money in real terms as the rate they receive from their ISA is less than the rate of inflation.

MetLife’s analysis shows someone making regular investments in the average cash ISA would have put away £24,911 since March 2009 and seen it grow to £26,272 for a gain of £1,729 – growth of 6.8% before inflation.

Annual average cash ISA rates have never been higher than 2.8% and have been as low as 1.4% while annual average inflation has been as high as 4.48% and as low as 0.04%. In 2010, 2011, 2012 and 2013 average inflation was higher than average cash ISA rates.

Simon Massey, wealth management director, MetLife UK said: “Cash ISA savers have suffered for seven years and are not guaranteed an improvement any time soon. It is understandable that many are wary of investing in the stock market with the risk of losing money but the unfortunate reality is that many are already losing out after inflation.

“With more than £61 billion invested in cash ISAs last year it is clear that savers and their advisers need to look at alternatives to ensure their money delivers more competitive returns.”

The table below shows average cash ISA rates and inflation and the real return: