Financial Planners and advisers have mixed views on their prosperity post-RDR, according to JP Morgan's first 'Adviser Prosperity Index.'

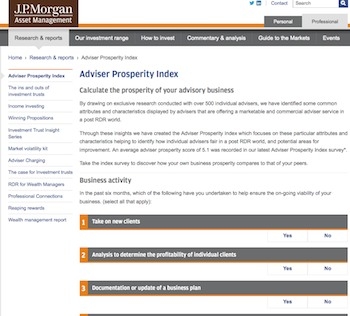

To help advisers share learning as RDR continues to impact their businesses, JP Morgan Asset Management, an IFP Corporate Member, has launched a new quarterly "Adviser Prosperity Index" to measure industry-wide adviser sentiment.

Responses from more than 250 investment advisers asked about business activity showed a mixed landscape, with an average Index rating of 5.1 out of a scale of 10.

{desktop}{/desktop}{mobile}{/mobile}

Those advisers with the highest index scores reported taking on new clients and analysing the lifetime value of individual clients, undertaking higher level qualifications and reviewing their businesses to improve efficiencies. Other characteristics of those who reported a 'flourishing' business (33 per cent) included higher utilisation of Paraplanners, engaging in frequent business planning and more success in proactively transitioning from commission-based charging to fees post- RDR.

'Flourishing' advisers were more likely to have taken on new clients in the previous quarter (72 per cent reported doing so) and on average reported more confidence in prospects for business expansion going forward.

"The Adviser Prosperity Index shows advisers boosting the value of their businesses through more proactive management are much more confident about their future prospects," said Jane Nicholls, head of Adviser Solutions, JP Morgan Asset Management.

She added: "Average sentiment is higher among advisers who are proactively de-risking their business models by outsourcing asset allocation and investment decisions, embracing centralised investment propositions that allow them to focus back on core areas like financial planning and meeting client objectives."

To calculate the prosperity of their businesses, advisers completing the questionnaire were asked to rank factors driving business activity, profitability and ongoing remuneration and to report on how these factors have changed since the prior quarter. As JP Morgan Asset Management gathers adviser sentiment data on a consecutive quarterly basis going forward, this should provide a timely snapshot of shifting advisory business trends.

Some other key findings from this quarter's initial Prosperity Index include:

• Just less than half of advisers reported they expect to see a rise in profits during the next 12 months; those in the 'flourishing' segment are significantly more optimistic than other segments

• Significantly more of the 'flourishing' segment generate over 60% of their business through contracted, on-going remuneration than any other segment

Advisers can gauge their own Prosperity Index score on J.P. Morgan Asset Management's adviser site am.jpmorgan.co.uk/adviser/adviserresearchandreports/adviser-prosperity-index/ and compare their ratings. Taking the survey advisers can see the particular attributes and characteristics that indicate how individual advisers fair in a post RDR world, as well as calculate potential areas for improvement relative to their peers.