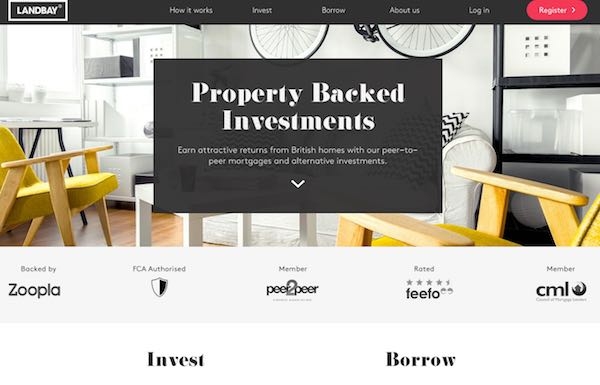

Landbay, the peer-to-peer investment platform specialising in buy-to-let mortgages, has claimed to be one of the first peer-to-peer platforms to launch an Innovative Finance Isa (IFISA).

The IFISA was announced in March 2015, and although the official start date for the new tax wrapper was officially April 2016, only a few platforms have so far been granted ISA status as the sector has been slow to get under way.

Landbay was one of the first platforms to receive authorisation for peer-to-peer lending from the FCA in December and was subsequently granted ISA manager status by HMRC in January 2017.

Both new and existing investors on the Landbay platform can invest up to the full ISA annual allowance of £15,240 in this tax year, rising to £20,000 at the start of the new tax year in April. The product launches with a minimum investment of £5,000 at a rate of 3.75%.

Since completing its first loan in 2014, Landbay has lent over £43m to professional residential landlords in the UK. Landbay was also a founding platform of the Zoopla Invest service which launched early in 2016.

John Goodall, Landbay chief executive, said: “When the Chancellor first announced the IFISA would launch in April 2016, it was hailed as a victory for savers and investors alike. It’s taken a little longer than expected for products to pass regulatory scrutiny and reach the market but we’re proud to be one of the first platforms to be offer investors the benefits of the tax wrapper and in time for the end of the tax year.

“At a time when investors are facing record low interest rates, and the prospect of rising inflation, our IFISA gives people the opportunity to earn a 3.75% return in a tax efficient manner, by lending to one of the UK’s best performing asset classes: buy to let.”

Landbay is an FCA regulated investment vehicle that uses peer-to-peer technology to give investors access to UK rental property. It is one of eight members of the Peer-to-Peer Finance Association and the only peer-to-peer member of the Council of Mortgage Lenders.

Landbay is fully authorised and regulated by the FCA, but peer-to-peer lending is not covered by the FSCS.