The minimum amount a couiple needs in retirement has fallen by £1,000, according to the latest update of the Pensions and Lifetime Savings Association’s (PLSA) Retirement Living Standards report.

But anyone seeking a moderate or comfortable retirement needs to find more cash to fund their post-work life.

The PLSA sets three different retirement lifestyles – minimum, moderate, and comfortable, to give people an indication of the kind of lifestyle they may be on track for.

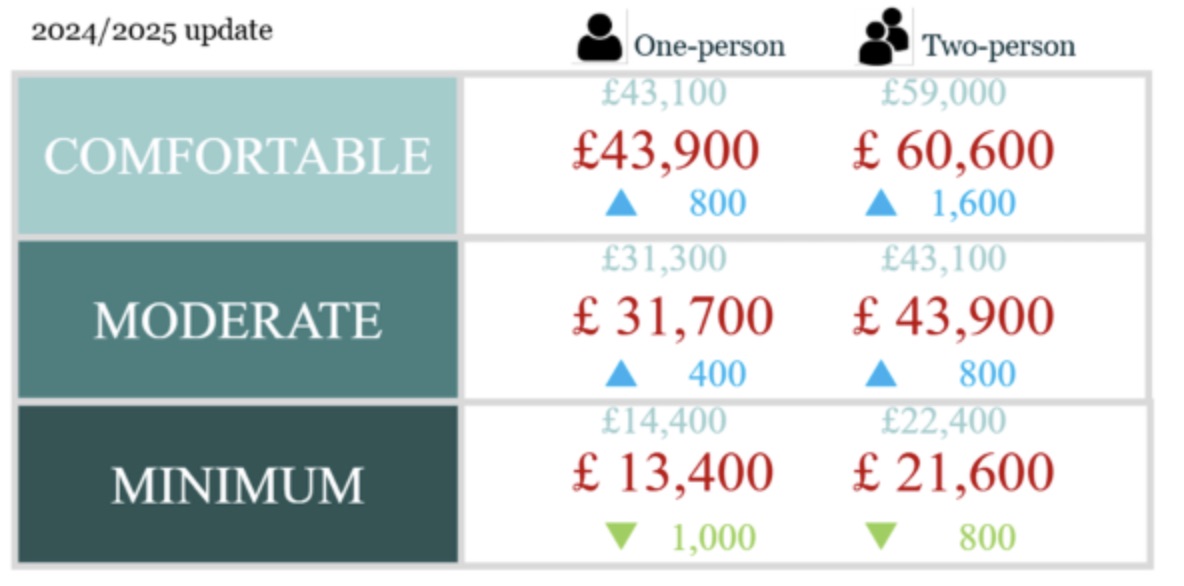

This year, the cost of a minimum retirement living standard for a one-person household fell by £1,000 a year to £13,400, while for a two-person household, it dropped £800 to £21,600.

The decreases are mainly down to a substantial reduction in energy costs with the fuel budget for a two-person house falling by £12.44 per week.

Participants also made some small spending adjustments to their living standards, clothing, hairdressing, technology purchases, taxi use, and charitable giving, the PLSA said.

The cost of a moderate living standard for a one-person household climbed by £400 a year to £31,700, while for a two-person household, it rose £800 to £43,900.

Anyone seeking a comfortable retirement needs to find an extra £800 for a one-person household and £1,600 for a two-person household, with the figures rising to £43,900 and £60, 600 respectively.

At the moderate and comfortable levels, energy costs are also lower – falling by £16.74 and £15.38 per week respectively for two- and one-person households.

Zoe Alexander, director of policy and advocacy at the PLSA, said; “For many, retirement is about maintaining the life they already have not living more extravagantly or cutting back to the bare essentials. The standards are designed to help people picture that future and plan in a way that works for them.”

Professor Matt Padley, co-director of the Centre for Research in Social Policy at Loughborough University, said: “The consequences of the cost-of-living challenges over the past few years are still being felt, and we’ve seen some subtle changes in public consensus about minimum living standards in retirement, resulting in a small fall in the expenditure needed to reach this standard.”

Ms Alexander said the role of the State Pension also remains vital, particularly for those at the minimum level. A two-person household who are both in receipt of a full new State Pension (worth £11,973 per person, or £23,946 combined in 2025/26) will be able to meet the costs of the minimum standard.

In addition, many people want to understand more than just the cost of retirement – they also want to know how big their pension pot might need to be to achieve that lifestyle.

• Independent research was carried out online by Yonder consulting with a nationally representative sample of 1587 UK adults aged 18+ between 17-18 May 2025.