More than six million Brits over-50 look set to retire on less than minimum wage, according to financial services provider LV.

LV says its report shows that:

• 28% of Britain's over-50 have no retirement savings in place

• 1.2 million pensioners currently rely on just the state pension for their retirement, receiving up to £5,890 a year less than the UK minimum wage

• £8.31 billion "lost" in retirement savings in the last year as over-50s cut back on contributions

The LV= State of Retirement Report1, now in its fifth year, reveals 6.25 million Britons aged over-50 (28%) have no pension plan in place and look set to rely on just the state pension in retirement, a huge increase on the 1.2 million people who live solely on the state pension today2. The basic state pension equates to an annual income of up to £5,587 and averages at £9,672 a year when you take into account additional benefit income (e.g. additional state pension, pensions credit etc)3. This is up to 51% lower than the income someone in the UK working full time on the minimum wage would earn, which is £11,477 per year4.

Even with Government plans to introduce a Universal State Pension at £140 per week, this will still provide an annual income significantly below the minimum wage.

When asked if they could live on the equivalent of the minimum wage in retirement, 43% said they couldn't live on that alone and over a quarter (27%) said they would really struggle.

For those who have private pension savings, the average income in retirement is currently £7,488 a year5. When you combine this with the state pension many people are still only living on marginally more than the minimum wage.

The LV= report also reveals that 15% of those already retired, or within five years of retirement have cut back on contributions to their long term savings over the last 12 months, with an average decrease of £296 a month or £3,552 per year. This equates to a total of £8.31 billion "lost" in retirement savings in the last year6. While these are significant cuts, a greater sum, £11 billion, was shaved off retirement savings by this group in 2011 (£343 per month)7. Savers into private pension plans have made the most significant cuts in 2012; an average of £523 per month over the last 12 months, compared to a £164 cut on average made by those with public sector pensions.

Ray Chinn, LV= Head of Pensions, said: "It is worrying that so many people are saving little or nothing for their retirement "wages", instead expecting to fall back on the state pension. While working hard up to their retirement to bring home a decent wage, I'm sure many will be disappointed to retire with an income equivalent of less than the minimum wage. If more people reflected on their pension as a "wage" that they will potentially be relying on for over two decades, they might feel more inclined to plan ahead."

Over half (58%) of those set to retire within five years have become more concerned over the last year about their financial situation and their level of savings for retirement. The biggest worry is the rising cost of food and utilities (76%), followed by the general poor state of the UK economy and national debt (63%). The effect of low interest rates impacting savings (61%), high inflation (61%) and the recent reforms to UK pensions (44%) are all major causes of concern pre-retirees.

The recent proposals from the Coalition Government around pension reforms have not been well received; the LV= report looks at over-50s views on which proposals and initiatives are fair bearing in mind the current economic backdrop:

• Nearly a third (32%) believe the introduction of a flat-rate state pension for all, and abolition of pension credits is a fair introduction

• Only 8% agree with the freeze in age-related allowances that will impact pensioners (dubbed the "Granny Tax")

• A quarter (24%) believe the raising of the retirement age to 67 for men and women by 2028, and to 68 by 2046 is justified

• Just 14% agree with the introduction of a new "defined ambition" pension scheme that would share the risk between the employer and individual

• Just 17% agree with taxing the state pension at source, before it is paid to pensioners (currently taxed after payment) is fair

• Over a third (34%) think changes to public sector pensions to make them more in line with private sector pensions is reasonable

• A quarter (24%) agree with the new auto-enrolment workplace pensions

• A third of all over-50s (30%), do not think that any of the above Government proposals are fair

Ray Chinn commented: "The Coalition Government has proposed a raft of changes in the run-up to, and in, the recent Budget, which will have a huge impact on retirees. Many feel it is this group who are taking the biggest hit as a means to help the economy to stabilise overall, which has come as a bitter pill to the older generations, especially as the current high inflation and low interest rate environment has already hit them hard. Unsurprisingly, very few are supportive of the Government's reforms or think they are fair - particularly when it comes to the freeze in age-related allowances and the rise in retirement age. Unfortunately many of these changes may be a 'necessary evil' given the demographic challenges ahead. Ensuring clear communication around these issues is key, otherwise there is a risk that people will be further alienated from the critical need to plan for retirement."

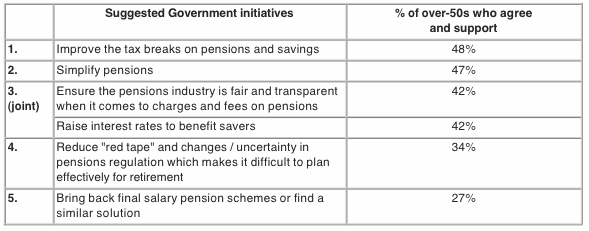

The over-50s believe more can be done by the Government to help people save for their retirement, and to save more. The top five things the over-50s believe should be done are shown in the tabe.