More women are failing to prepare adequately for retirement and remain well behind the preparation levels of men, says a new report.

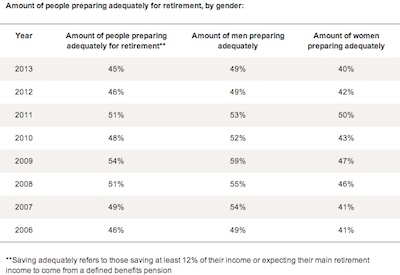

According to the Scottish Widows 2013 Women and Pensions Report only 40 per cent of women, compared to 49 per cent of men, are preparing adequately for later life, a drop from 42 per cent last year and 50 per cent in 2011.

The ninth annual survey of over 5,000 people found that while over a third (37 per cent) of women have no pension whatsoever, the same applies to just over a quarter (27 per cent) of men.

The picture is little better for those women who are saving, with the report finding that they are managing to put aside £182 a month on average although this is well below the average amount of £260 among men. This creates a gender pension savings gap of nearly £1,000 a year.

Lynn Graves, head of business development, corporate pensions at Scottish Widows, said: "It is worrying to see that women are continuing to lag behind men in retirement savings.

"The number of women preparing adequately for retirement has dropped from last year to a record low. This growing gender gap in retirement savings means that women are facing an ever increasing shortfall when it comes to retiring and must act now to ensure they will not be left exposed in later life."

The report found that women are coming up against barriers to saving at every stage of life, with different lifestyle factors taking their toll on women of different ages.

{desktop}{/desktop}{mobile}{/mobile}Women in their 20s were found to be tied down by short-term financial pressures and are prioritising living expenses (42 per cent), paying off debts (26 per cent), travel and holidays (23 per cent) or saving for a property (18 per cent) over saving for retirement. Over half (54 per cent) of 22-29 year olds do not have a pension, compared to 37 per cent of the general female population.

Perhaps due to family commitments, only 50 per cent of women in their 30s work full-time compared with 81 per cent of men of the same age, meaning 30-something women bring in an average gross income of £19,200 - way behind the £28,700 that the average 30-something man takes home.

Career breaks and cutting back on hours have a knock-on effect on women's ability to save, with women in their 30s only saving £87 a month on average towards retirement, outside of pension and property investments. This is compared with the £151 that their male counterparts are saving each month outside of pensions and property.

By the time women reach their 40s, their financial priorities have changed, with almost 1 in 4 (23 per cent) 40-49 year olds saying they had prioritised financially supporting their children over retirement saving in the last five years. Some 24 per cent also said they expect their partner's income to help support them in retirement, despite the fact that 79 per cent do not know what their partner would be entitled to from their pension fund if they were to separate.

Lynn Graves added: "Of particular concern is the number of women in their 40s who are planning to rely on their partner to help support them in retirement, but are unsure of what their pension provision would be were they to separate. We should encourage these individuals to take full responsibility for their financial independence.

"The pensions industry, Government and employers need to work together to raise awareness of the unique lifestyle pressures that take their toll on women's savings at different ages and help women prioritise their pensions. Initiatives such as auto-enrolment are fundamental in helping the nation's workers to think about saving, but women outside the workplace need greater access to information and guidance about other retirement options."