The Work and Pensions Committee has sent questions to The Pensions Regulator and Carillion pension trustees on why Carillion collapsed with a “giant pension deficit and a mountain of debt.”

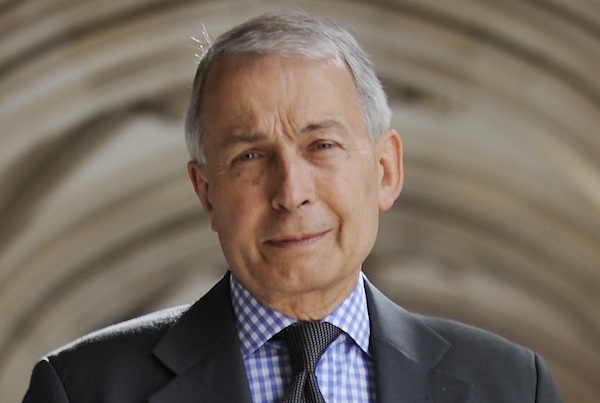

Frank Field, MP and chair of the committee said: “I am pleased that the Liaison Committee will be investigating Carillion - the company’s collapse begs questions across government.

The House of Commons Liaison is a committee of the British House of Commons and is made up of the Chairs of each of the select committees.

The liaison Committee’s many roles include a scrutiny of draft bills, oversee government departments finance and performance, public appointments and giving advice to the House of Commons Committee on select committee matters.

“We have some specific concerns on the pensions side. It beggars belief that a company can be allowed to run with such apparent recklessness - and be so lucrative for the directors and shareholders - when it has a giant pension deficit and a mountain of debt.

“I will be proposing we take evidence from the company directors, the trustees, the pensions regulator and the auditors who somehow concluded Carillion was a going concern.

Carillion, one of the UK’s largest construction companies with major UK government public sector contracts and employer of 20,000 people in the UK, announced on Tuesday, that it had “no choice but to take steps to enter into liquidation with immediate effect.”

The largest construction company in the UK is reported to have been £508m in deficit prior to liquidation.

Tom McPhail, head of policy at Hargreaves Lansdowne said: “Members of the Carillion scheme will be understandably anxious about their pensions.

“Assuming the company goes into administration and the scheme is taken over by the Pension Protection Fund, retired members will continue to receive their pensions in full, whilst those yet to reach retirement will see cuts of typically between 10% and 20%.

He added: “There’ll be an initial reduction of 10% when they reach retirement, plus they may lose some of their inflation proofing and higher earners may have some of their pension capped. The current cap on pension payments is £34,655.05, though for long serving employees it can be higher.

“The reported Carillion scheme deficit of £580 million looks big, but thanks to prudent management in recent years the Pension Protection Fund currently has a surplus of over £6 billion so they can absorb this hit if they have to. Scheme members can expect the administrators and the PPF to work together to ensure there is continuity of payments.”