Nest has put together a phrasebook of key financial terms as 96 per cent of people say pensions are hard to understand.

Research by Nest (National Employment Saving Trust) and YouGov questioned almost 2,000 people and found only 15 per cent of people felt the language used by pension providers was straightforward with respondents described it as ‘confusing’ and ‘complicated’.

Over half of respondents said they found the language so difficult that they could not work out the best options available to them.

Some 29 per cent also said they would be put off saving for retirement because they found pensions confusing.

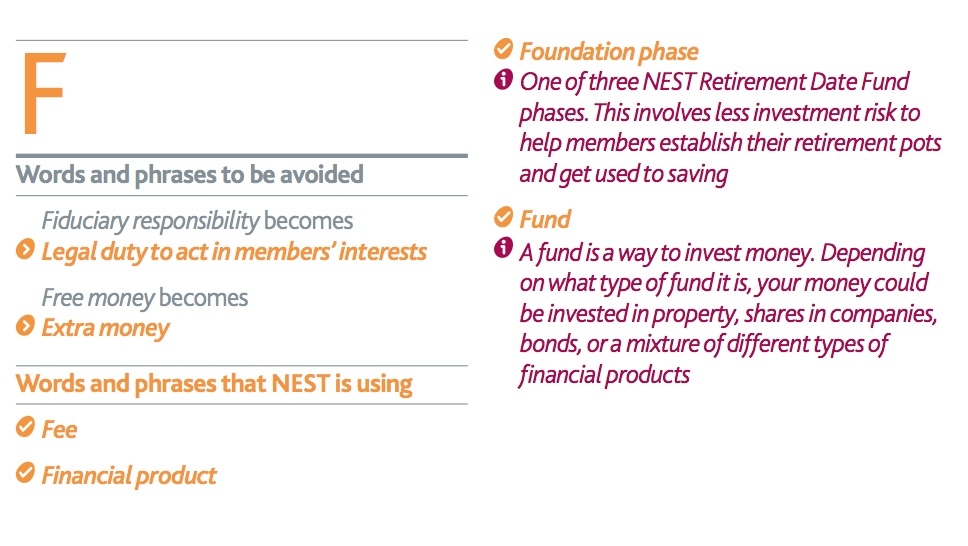

In response, Nest has created a phrasebook to define words such as annuity, nominated beneficiary and guarantee period.

For example: ‘bonds’ are defined as ‘a loan, usually to a government or company. The borrowed money is paid back at an agreed date with interest.’

Some words are not used by Nest altogether and have been replaced by simpler terms.

For example: ‘enhanced life annuity’ becomes ‘a retirement income based on your lifestyle’.

Nest chief executive Tim Jones said jargon could be damaging people’s chance to build a better retirement income.

He said: “The latest version of Nest’s phrasebook includes jargon-busting terms we’ve tested with our likely members and their employers to help make pensions easier to understand.

“Nest’s research shows that getting the language right is a challenge all pension providers will need to tackle.”