A new business has been launched with the aim of becoming a ‘financial adviser in your pocket’ for younger people.

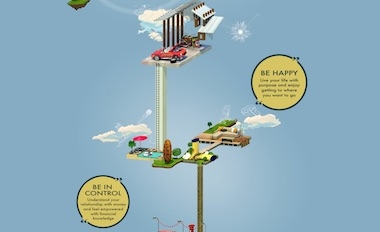

The Lifehouse.Co will be using “a series of mobile applications” to help the so-called millennial generation who have been “rocked by financial uncertainty” on matters such as pensions, housing and loans.

Neil Darke, the former Canaccord Genuity Wealth Management chief executive, is behind the new business. Initial products and services will be free, raising questions about its financial stability.

Mr Darke said: “Like so many online start-ups, we know that as the community grows, the revenue opportunities will come.

“We will require further funding to fulfil the development of our planned products and services but, for now, we just want to get our customers on the right path.”

The advice and wealth management industry fails to cater for young people because they’re ‘uneconomic’, he said, pointing to an industry website showing only case studies for older people.

Mr Darke believes automated tools can help and engage young people in personal finance in ways that existing businesses have failed to do.

He said: “The development of robo-advisors is a great start but we also have to help young people take control over their finances before they can become investors.

“The truth is many people’s financial needs are not particularly complicated, and simply getting the basics right and developing healthy financial habits will take you a long way towards your goals.

“People used to be taught how to save and budget, but these days they are simply a loan target and prey to ever more sophisticated marketing strategies that use their behavioural biases against them.”

He said he wants young people to “combine new financial habits and know-how with emotional understanding”.

Mr Darke has worked in a number of large institutions across the financial markets spectrum – in asset management, stockbroking and most latterly private wealth management.

The Lifehouse.Co said it would be donating a percentage of any profits to charities that promote financial education or help alleviate financial distress.

The firm is currently looking for testers in the UK aged 25-30 with an IOS smartphone.