HNW research company MDRC says the number of HNW individuals fell between 2010 and 2012. The drop came after many years of growth.

The Dimensions of European Wealth report examines the size of the HNW sector in the EU by country and looks at the key issues which have affected the HNW sector in the 2 years since MDRC's last report on this topic.

The report found that:

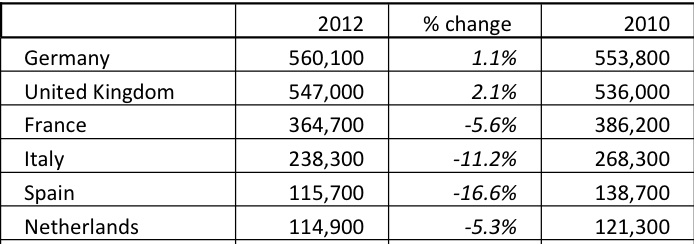

• The number of high net worth individuals in the EU fell by 3.9% to 2,612,600 between 2010 and 2012 although numbers in the UK grew by 2.1 per cent from 536,000 to 547,00

• The EU's largest HNW sector is in Germany where there are 560,100 individuals with more than $1m equivalent in investable assets

• Only in Slovakia and Poland are the HNW sectors larger in 2012 than in 2008 in $ terms

• The low availability of credit to SMEs is cited as a key constraint on EU wealth creation. Personal investments are increasingly being used to re-finance businesses activities.

MDRC says that the outlook for the sector continues to be uncertain, with continuing pressure on new wealth creation. MDRC says the modest fall in HNWI numbers, however, masks some significant changes in wealth and the appetite for more adventurous investments. The appetite for more risky investments remains highest in Western Europe and Scandinavia but there are signs investors are reluctant to invest in equities.

According to the report: "The total number of high net worth individuals in the EU fell by 3.9% to 2,612,600 between January 2010 and January 2012. Over this period there were some 200,000 new HNW individuals, but this growth was more than offset by some 300,000 individuals whose wealth fell below the HNW threshold.

"Across the EU there has generally been very little sustainable wealth creation since 2010, any increase in HNW numbers is attributable either to an increase in the value of in existing investments or to the effects of exchange rate changes. However, these high level figures mask a change in HNW behaviour, away from investment in financial assets towards investment in tangible fixed assets: particularly residential and commercial property. This change has been driven by a continuing concern about the health of the financial system in general and of the Euro in particular."

MDRC analyses affluent and high net worth wealth across Europe in the 27 states of the EU, including the UK, and in neighbouring countries.