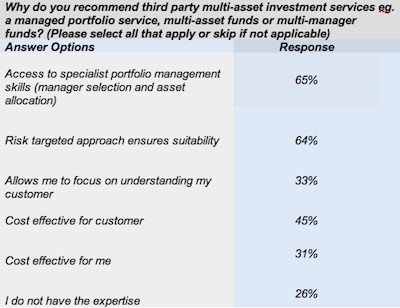

According to new research 65 per cent of advisers said that the main reason for recommending outsourced investment services was to gain access to specialist portfolio management skills.

Just over a quarter (26 per cent) of advisers said they did not have the necessary expertise to manage portfolios, recognising the role specialist investment managers can bring.

The second most popular reason for using outsourced investment services, voted for by 64 per cent of advisers, was to achieve a risk targeted approach to ensure on-going suitability. Risk-targeted portfolios can avoid the issue of portfolio drift as the portfolios are specifically managed to stay within set volatility parameters. The research was carried out for Skandia, part of Old Mutual Wealth,

A third (33 per cent) of advisers said recommending outsourced investment services enables them to focus on understanding their customers. Using a managed portfolio service or multi-manager solution, especially those that are risk targeted, reduces the need for advisers to make fund selections, manage asset allocations and make changes to portfolios, and instead allows advisers to focus on the customer and provide advice in other areas of wealth planning.

{desktop}{/desktop}{mobile}{/mobile}

Nearly half (45 per cent) of advisers say they recommend outsourced investments as a cost effective solution for their customers. With the introduction of adviser charging the cost of the investment process has become more transparent and many customer segments are unlikely to be able to afford a bespoke service or see the value in it. Many customers may favour an outsourced solution that meets their needs, but may also keep costs down.

With customer outcomes and clear cost structures becoming ever more important, packaged investment solutions are more in demand than ever before.

James Millard, director of investments at Skandia, said: "Advisers value and recognise the expertise portfolio managers can bring and their ability to manage risk in an effective way for their customer. The focus on value for money is more prominent than ever, and outsourced investments can potentially reduce costs whilst delivering favourable customer outcomes. We expect the demand for high quality managed solutions to increase."

The Skandia adviser insights survey was conducted in September 2013 and gathered responses from 671 financial advisers. For the table above 460 answered the question and 211 skipped it.