The total property wealth of over-55s in England will double to almost £2.5trillion by 2035, according to research by Age Partnership, a retirement income specialist.

The company says the findings highlight a major long-term shift towards the importance of housing wealth in retirement Financial Planning.

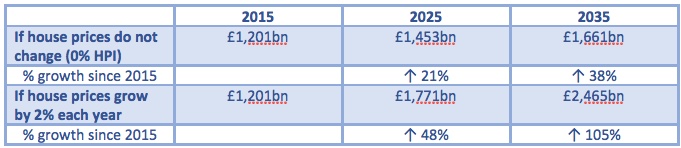

According to Age Partnership, over-55s in England are currently sitting on £1.2 trillion worth of property wealth. In the next twenty years, this is forecast to more than double (105%) to £2.5 trillion, if property prices in the UK rise by a modest annual average of 2%.

Even if house prices remain completely flat, the housing wealth of over 55s is forecast to increase by 38% to £1.7 trillion by 2035. (see table 1)

With inflation currently hovering around zero, any increase in housing wealth currently means a real terms increase in spending power, says Age Partnership.

Table 1: Forecast growth in the property wealth of over 55s, 2015 – 2035

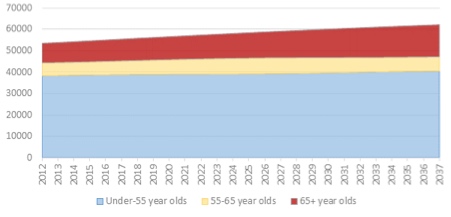

The 15.9m people in England currently aged 55 or older is expected to rise by over a third (33.8%) to 21.3m by 2035 as people live longer. This compares to a much slower growth of 10.8% for the population of England as a whole, says the company.

One of the main drivers for the growth in this age group is that the large post-war baby boomer generation that is currently at or nearing retirement age is expected to benefit from longer life expectancy. This generation has also benefited from rising house prices, says Age Partnership.

Graph 1: Number of people aged 55 or over set to grow rapidly over the next twenty years (thousands)

Simon Chalk, equity release expert at Age Partnership, said: “We are witnessing a radical long-term shift towards people reaching retirement age with a hugely significant nest egg in the form of property wealth. In twenty years’ time, people at or near retirement could be able to tap into a combined extra £1.3 trillion of property wealth to help fund their retirement.

“Many baby boomers currently reaching retirement age are fortunate enough to have amassed both property wealth and a sizeable pension. But for those whose pension savings aren’t sufficient to fund the retirement lifestyle they want, their housing wealth can be used to top up their pension income or help fund major purchases. As the number of people retiring with generous defined benefit pensions declines over the long-term, housing wealth could become even more important in retirement planning in 20 years’ time than it is today.”

Age Partnership’s property wealth forecast is based only on over 55 households where the property is owned outright (that is without a mortgage). It uses ONS population forecasts for England between 2012 and 2037, English Housing Survey data on the number of people who own their home outright and Land Registry data on current average house prices.