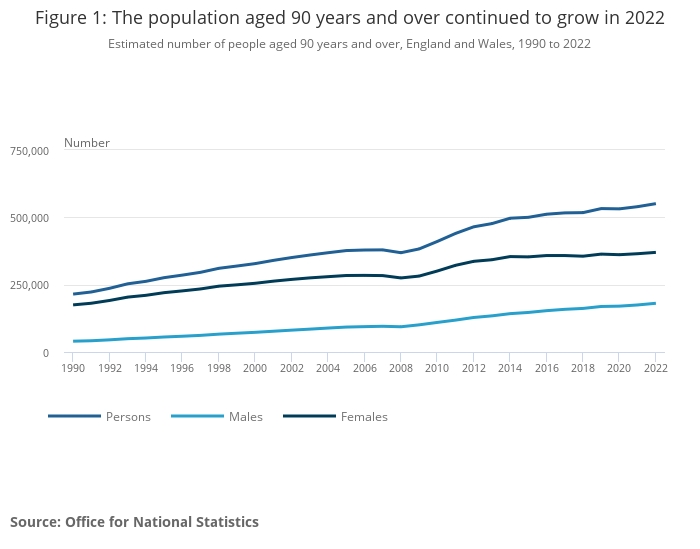

The over-90s population in England and Wales grew by 2.1% over 2022 to a record high of 550,835 people, according to data from the Office for National Statistics.

Meanwhile the number of centenarians has more than doubled since 2002, with 15,120 recorded in England and Wales in 2022.

While the figures are something to celebrate, they raise financial challenges that the government and consumers need to get to grips with in the coming years, according to Helen Morrissey, head of retirement analysis at Hargreaves Lansdown.

She said it highlights the increasing pressure being placed on the State Pension, and the government’s headache in managing the costs of a system people could be claiming from for thirty years.

Ms Morrissey said: “Mechanisms such as increasing state pension age can only go so far, as many people will simply be unable to continue to work after a certain point. The triple lock’s role as an uprating mechanism also needs to be reviewed.”

She said it’s an issue that government needs to get to grips with quickly.

Ms Morrissey said: “We are hitting a real tipping point when it comes to pensions, and we will have to get to grips with some difficult financial truths if we are to build a resilient retirement.”

Catherine Foot, director of Phoenix Insights, said much of how our society is structured doesn’t support people living into their 90s and beyond.

As such she said it’s time to make changes in areas such as financial security, work, skills, health and caring to transform the way we respond to the possibilities of longer lives and tackle the gap in healthy life expectancy between rich and poor.

Ms Foot said: “The need for change is striking. When today’s centenarians were born, the prospect of someone living to the age of 90 in the UK was very small. Average life expectancy was around mid-50s to 60 years old, and only one in ten men and two in ten women were likely to reach their 90th birthday.

“Today, well over of half of UK babies will live to at least 90.”