Pension freedoms amnesia: Some to run out of money too fast

A minority of pension holders appear to have forgotten why they saved in the first place, an analyst says, after new data showed they might run out of money in less than a decade.

The Association of British Insurers has published figures for the first complete year since the Freedom and Choice reforms, from April 2015 to April 2016.

ABI officials said these indicated a minority were withdrawing too much too soon and at rates that would deplete their savings too fast if they are reliant on their pension pot as their main source of income.

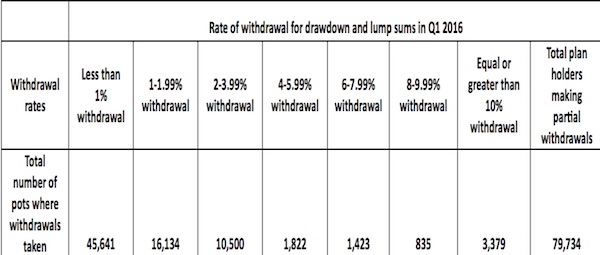

In the last quarter, four per cent of pots had 10% or more withdrawn, and many others were taking their whole pot in one go.

Officials said, however, they cannot identify from the data whether these savers may have multiple pots or other regular income.

Andrew Tully, pensions technical director, Retirement Advantage said: “There are a minority who it would appear have forgotten the reason they saved in the first place, to pay them a salary in retirement.

“Let’s hope these people have other sources of income for retirement, as at the withdrawal rates the numbers suggest, they will very quickly deplete their funds.

“The shopping around process continues to fail, and less people are actually looking for a better deal since the start of pension freedom. This leads to poor value whether people are choosing drawdown, annuity or a blend of both to provide their retirement income.”

Above: ABI table

Yvonne Braun, the ABI’s director of policy, long term savings and protection, said: “There may well be other factors at play here, such as people having other retirement income, for instance, final salary pensions or multiple pots. But this is a warning sign that requires further investigation.

“We need a full picture of these customers’ circumstances and income, which is something we urge regulators and the Government to work with all stakeholders to examine.

“The fall in annuity sales in the most recent quarter reflects ongoing pressure on rates, which will not have been helped by the recent decision to lower interest rates to a 300 year low, and further quantitative easing measures.”

Despite the concerns raised, the figures showed the majority of savers were taking a sensible approach, with 57% pots with 1% or less withdrawn during the last quarter.

Figures show for pay-outs:

· £4.3 billion has been paid out in 300,000 lump sum payments, with an average payment of £14,500.

· £3.9 billion has been paid out via 1.03 million drawdown payments, with an average payment of £3,800.

Since the reforms came in, for funds invested in new products:

· £4.2 billion has been invested in 80,000 annuities, with an average fund of £52,500.

· £6.1 billion has been invested in 90,700 drawdown products, making the average fund invested nearly £67,500.